‘A lot of risk’

Homeowners are getting increasingly tempted by HELOCs.

RubyHome, a luxury real estate brokerage, analyzed web traffic data and found that searches for the term “HELOC” were up 305% over the past year.

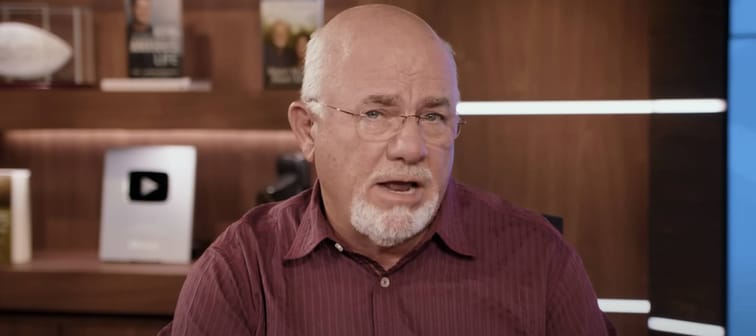

In Ramey’s opinion, taking out a HELOC is just “moving debt from one pile to another, with a lot of risk.”

The risk is the potential of losing the home. HELOCs are backed by the value of the underlying real estate, so failing to pay back the loan could result in foreclosure. And it’s not as if HELOCs necessarily come cheaper than traditional mortgages.

For one thing, their interest rates are variable. “You know what they base the interest rate on?” Ramsey said on another recent episode of his show. “Whatever they feel like. It’s completely variable and not indexed to any outside thing.”

Sure enough, recent data supports Ramsey’s objections: the average interest rate on a HELOC is 9.02% while an average 30-year fixed mortgage is less than 8%, according to the Federal Reserve.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreWhy are HELOCs so popular?

A report by the Urban Institute suggests that HELOC lenders could still be benefiting from the recently lapsed cheap-credit era. Homeowners who in previous years locked into ultra-low long-term mortgage rates don’t want to give those rates up by selling their homes.

So those who want to access their accumulated equity may be more likely to seek other methods — namely, temporary lines of credit at higher rates — so as to protect their cheap primary mortgage.

Ramsey doesn’t buy that thinking. In fact, he’s not a fan of any housing debt. He advises people to limit their lifestyle upgrades and pay in cash for property when possible.

“Ultimately we want to be 100% debt-free,” he said during the episode. “Instead of figuring out a time when debt is OK, let’s figure out a way to avoid it.”

Indeed, about 23% of homeowners in the U.S. own their property free and clear without any mortgage. These lucky households are insulated from the credit cycle. Higher mortgage rates don’t impact them. They also have the flexibility to sell their home and buy another for cash, which is what Ramsey suggests most people aspire to.

Find the Best Mortgage Rates to Fit Your Budget

Looking for a great mortgage rate? Don’t overpay on your home loan! Get updated mortgage rates, expert insights, and tips to lock in the best deal tailored to your needs. Save on monthly payments and make homeownership more affordable. Start your journey to savings now.