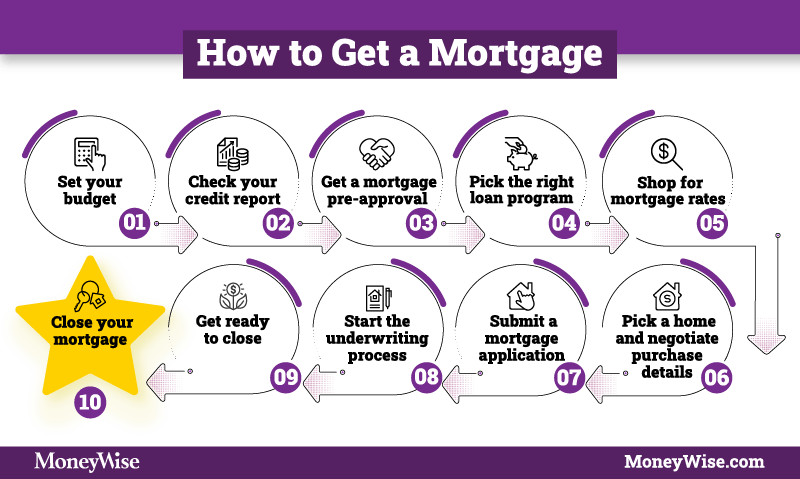

1. Know how much house you can afford

First: Are you ready to buy a home? It takes more than rock-bottom interest rates to afford a place of your own.

After the economic crisis of 2008, over 10 million families lost their homes to foreclosures. A big reason was that banks had given out too many mortgages borrowers couldn't handle.

Today, there are laws to make sure a lender cannot offer you a mortgage that will cost more than 35% of your monthly income.

Even so, a common rule of thumb says to spend no more than 25% of your monthly take-home pay on your mortgage payment. Once you have that 25% number, use a mortgage income calculator to see how much home you can afford, given a certain down payment and interest rate.

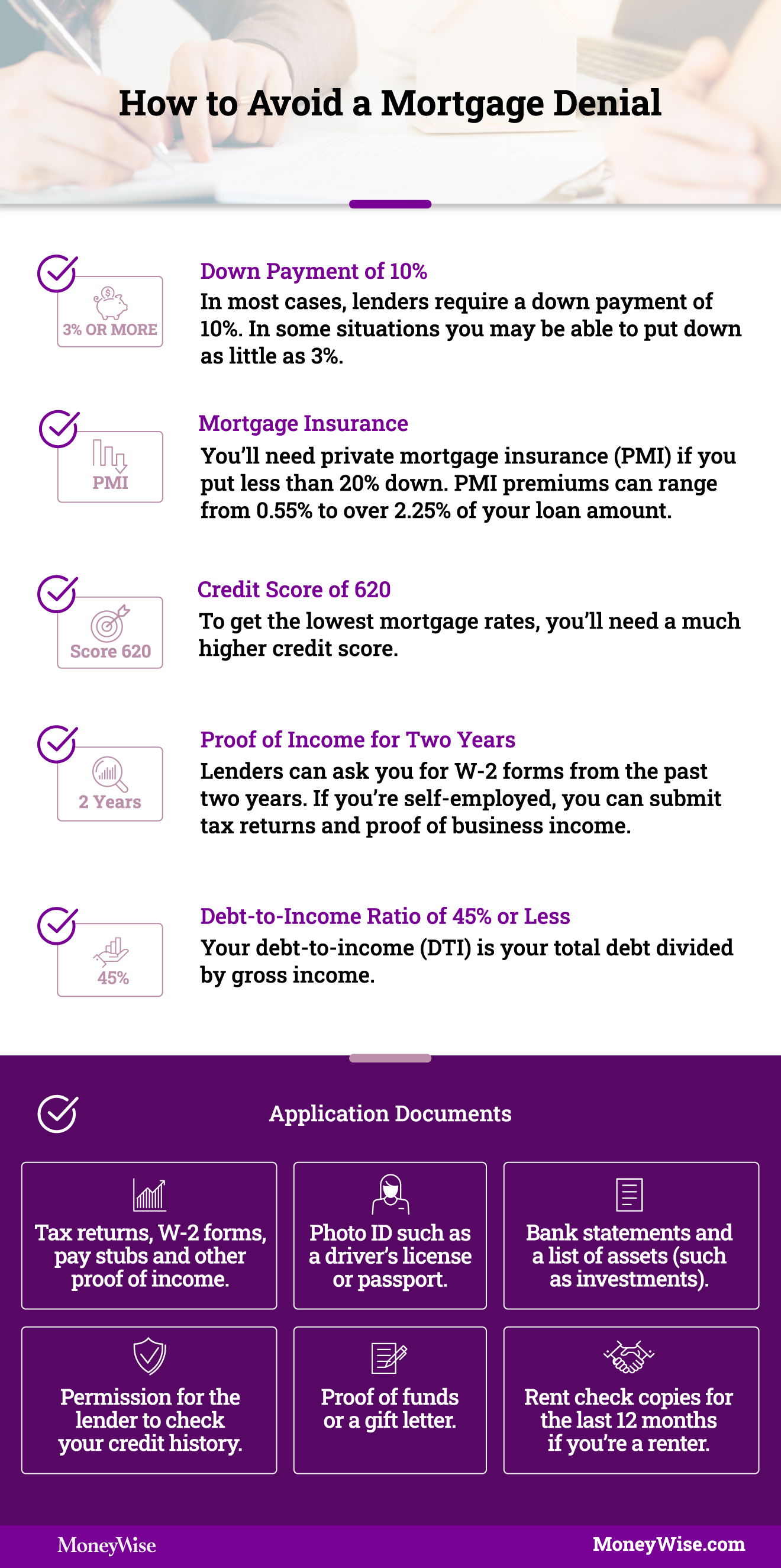

But that's not the only cost to consider — you'll also need money for closing costs, taxes, maintenance, home insurance and your down payment. And with standard ("conventional") mortgages, when you put down less than 20% of the purchase price, your lender will require you to buy private mortgage insurance, or PMI.

With all those costs, it’s important not to jump in too quickly. As soon as you get the urge to buy, start saving as much as possible. Try stashing your money in a high-yield savings account, which will help it grow the quickest.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn More2. Check your credit score

Your credit score is a three-digit number that reflects how well you handle money. You'll need to see it before you apply for a home loan because the higher your score, the more banks will be willing to work with you, and the lower your mortgage rate will be.

Credit scores range from 350 to 850. If you haven't seen your score in a while, you can easily check your credit score for free right now.

If yours is above 720, you'll generally be considered a good credit risk, but different types of mortgages have different minimum credit score requirements:

- Conventional loans (most mortgages): 620

- FHA loans, insured by the Federal Housing Administration: 580

- VA loans, guaranteed by the U.S. Department of Veterans Affairs: 580

- USDA loans, backed by the U.S. Department of Agriculture: 580

Keep in mind that those minimum scores for FHA, VA and USDA loans aren’t hard-and-fast limits. You might still get funded through one of those loan programs if your score is down near 500, but 580 is considered a red line many lenders may not want to cross.

If your score is too low, get rid of some debt, which will reduce your debt-to-income ratio, a key metric lenders will use to determine your creditworthiness. Paying off credit card balances will also help by reducing your rate of credit utilization, a measure of how much of your available credit you're currently using.

Sometimes, better credit just takes time. Make sure your credit history isn’t filled with a bunch of short-lived accounts. Lenders want to see consistency and a willingness to commit to long-term financial relationships.

3. Get a mortgage preapproval

Before you head out with a real estate agent to look at homes, it’s a good idea to get pre-approved for a mortgage.

A preapproval is a formal letter from a lender that details how much money you can borrow and at what interest rate.

Don't worry, you're not committing to anything by getting a preapproval, and you can always switch to a different lender if you find a better deal.

Once you've applied for a loan and the lender has done a thorough review of your supporting documents and credit history, it will tell you how high it's willing to go with your loan. And then, you'll know how much you can spend on a house.

A preapproval letter is a good thing to have in your back pocket when you're ready to make an offer on a home, because it shows the seller that you'll be able to get financing.

Preapproval also can help you lock in an interest rate prior to purchasing your home. So if mortgage rates rise, you won’t have to worry about paying a higher rate on your loan.

Preapproval is not the same as prequalification. A prequalification is a relatively quick going-over of your financial situation that allows a lender to give you a general idea of what you might be able to buy. There's no guarantee that the loan amount included in your prequalification letter is what you’ll ultimately get approved for.

Need cash? Tap into your home equity

As home prices have increased, the average homeowner is sitting on a record amount of home equity. Savvy homeowners are tapping into their equity to consolidate debt, pay for home improvements, or tackle unexpected expenses. Rocket Mortgage, the nation's largest mortgage lender, offers competitive rates and expert guidance.

Get Started4. Select a mortgage type

Home loans come in different varieties, which means you’ll need to decide which type makes the most sense for you. Here’s a rundown of a few of your options:

Pick a program that works for you

A conventional mortgage is the most common way to finance your new home. These are any loans that aren't insured or guaranteed by the federal government.

The requirements for a conventional mortgage can be stricter, and typically are only available to buyers with solid credit scores. Again, if you can’t muster at least 20% of the home’s purchase price for a down payment, private mortgage insurance premiums will be tacked onto your monthly payments.

Conventional mortgages can be either "conforming" or "nonconforming." Conforming loans follow (conform to) specific dollar-amount limits set by Fannie Mae and Freddie Mac, two government-sponsored companies that buy mortgages from lenders. Nonconforming, or jumbo loans, go beyond those limits.

An FHA loan is guaranteed by the Federal Housing Administration and is aimed at helping first-time homebuyers and those with lower or moderate incomes.

The guidelines for these loans are less strict: The credit score requirements aren't as high as for conventional mortgages, and an FHA loan allows a borrower to make just a 3.5% down payment.

USDA loans are for middle- and low-income borrowers in rural and suburban areas. No down payment is required.

VA loans are intended for veterans and active-duty members of the military, including the National Guard and reservists, as well as certain family members. These loans also don't require a down payment.

Fixed or adjustable rate

With a fixed-rate mortgage, your interest rate will hold steady for the life of your loan.

If you bag a 30-year fixed-rate loan at 3.05%, that’s what you’ll pay from beginning to end. Your monthly payment also won't change, so fixed-rate mortgages make budgeting a lot easier.

It’s pretty helpful to know that if interest rates suddenly spike, yours won’t. But if rates suddenly drop to new lows, as they have in recent years, you’ll be stuck at the higher rate — unless you pay to refinance into a new loan.

Adjustable-rate mortgages, also known as ARMs, generally start out with lower interest rates. But after a certain number of years, the rate can change — or "adjust" — on a regular basis, up or down, in sync with a benchmark interest rate like the prime rate.

ARM rates are described using two numbers that look like a fraction, and each part refers to a length of time. With a 5/1 ARM, for example, the first number means your initial rate will stay the same for five years. After that, your rate will adjust every (one) year.

At the outset, ARMs are usually the cheaper option than fixed-rate mortgages. But if interest rates spike, so will your ARM rate — and monthly payment amount. The predictability of a fixed-rate mortgage carries a lot of value.

Mortgage term

Before the lender agrees to give you that hefty mortgage loan, you’ll agree on the terms for your repayment. The most common term for a fixed-rate mortgage is 30 years, but terms of 20, 15 and even 10 years are available.

The major advantage to stretching out the term is lowering your monthly payment. With lower payments, you can also usually get approved for a higher overall mortgage.

But if you can manage the higher payments, 15-year mortgages have significant benefits: Interest rates are lower on shorter-term loans, and your lifetime interest costs will be much smaller versus a longer-term mortgage.

APR

The annual percentage rate, or APR, gives you a more precise idea about total borrowing costs, compared to a simple interest rate.

So how exactly does an APR differ from an interest rate? APR represents your interest plus a few other expenses.

At a quick glance, you can see the annual costs of your interest, mortgage broker fees and other lender charges that are part of the loan process. That means the APR will normally be higher than the interest rate.

5. Shop lenders

The mortgage industry is intensely competitive. Lenders are perpetually trying to outdo each other in the battle for your business, so take the time to do some comparison shopping.

According to a Freddie Mac study, borrowers who compare quotes from five mortgage lenders can save about $3,000 over time, compared to someone who seeks out only one loan offer.

Pay close attention to interest rates, APRs, closing costs and discount points, which are upfront fees that lower your interest rate.

But be sure to look at other aspects of their loans, too, including penalties and various terms and features that might impact the overall cost of your mortgage. The devil really is in the details — ask anyone who has ever been surprised by a balloon payment or gargantuan prepayment penalty.

However, if you’re a good candidate, the best mortgage lenders will want your business. That means they may even be willing to knock the costs down a bit — if you ask.

Remember, you can always partner up with a mortgage broker to help guide you through the process of nailing down your first home loan. Once your mortgage closes and you’ve bought your first home, you’ll have one more person to celebrate with.

6. Pick a home and submit your mortgage application

Once you find the place of your dreams, you’re ready to submit your mortgage application.

If you’re using the same lender that preapproved you, you’ll only need to update your most recent financial information.

However, if you’ve found a new lender that offers a better deal, here’s what you’ll need to submit as part of your formal application:

-

Proof of income. Buyers generally need to provide W-2 wage statements or tax returns from the past two years, along with pay stubs from the past 30 days. You may also need to prove how long you've been at your job; your original employment contract will come in handy, if you still have it. If you’re self-employed, you’ll need to prove to the lender that your business makes enough money. Don't forget documents to show any income outside your regular employment, such as rent from an investment property, dividends from stocks you own, cash from a side hustle or alimony.

-

Proof of assets. The lender will want to ensure you have the cash for a down payment and closing costs. You’ll need to provide bank statements or a proof-of-funds letter to show you’ve got the money. If you’re getting some help from family, you may also need a gift letter to prove that their financial assistance isn’t a loan.

-

Proof of identity. In addition to your Social Security number, the lender will need a signed authorization to pull your credit report.

7. Begin the underwriting process

Feel like a lot of steps? It is, but you’re almost there. Now you’re waiting on your application to get approved, and this is when the lender will take a look at you as a borrower and finally decide if you’re really eligible (and worth the risk) for the loan.

So, what will the lender be looking at?

-

Credit and job history. The lender wants to feel certain you’ll be able to keep up with your monthly payments. Even if you are working, a lender might get nervous if you’ve switched jobs a few times lately. It helps to have stayed at your job for at least two years, so if you're thinking about making a switch, consider waiting until after you secure your mortgage.

-

Your other debts. If you have other debts — like student loans or a sizable balance on your credit cards — it might signal to lenders that you’re not ready to add more. Lenders will look at your "debt-to-income ratio," which is calculated by adding up all your monthly debt payments and dividing them by your gross (pretax) monthly income. You want that number firmly under 43% to avoid scaring away lenders.

Overall, you want to give the bank the impression that you are a reliable person and won’t flake out on your mortgage when times get tough. It can help to show that you've been in your current residence for a year or more.

If a lender sees you tend to break your lease every six months, or if you have any history of eviction, that can be a red flag. And if an eviction is on your record, the lender will dig deep into your past and may even contact your former landlord.

This is also when the lender would want the home appraised. An appraiser will research the house to tell the underwriter how much it’s truly worth. Underwriters want to know that you’re not spending (and borrowing) more than the property is worth — just in case you stop paying your bills, and the lender needs to sell the home to recover its costs.

8. Get ready to close

Once you're approved for your loan, take a moment to celebrate.

Once you've done a dance around your living room or have exchanged high fives with your significant other, it’s time to get back to work — because the process isn’t over yet. Closing costs are an important (read: costly) part of your homebuying journey.

Here are a few of the closing items to consider:

- Discount points. Want to bump your mortgage rate lower? You can pay discount points, those fees we mentioned earlier that can "buy down" your rate. This option makes the most sense if you plan on being in your home for a while.

- Homeowners insurance. Find the best rate on insurance before closing — otherwise your lender may choose a policy for you. With a bit of comparison shopping, you may be able to save $1,000 per year on your home insurance.

- Title insurance. Once you have the title, you legally own the property. The fee covers the search for essential documents as well as title insurance, which provides some protection if someone comes along and claims an interest in the home.

- The final walk-through. If you’ve agreed on repairs after the home inspection, this is the time to make sure they’ve been completed. You also should make sure there’s been no new damage since the inspection.

- A cashier’s check. Homebuyers will usually pay 2% to 5% of the purchase price of their home in closing fees — and writing a personal check won’t cut it. You’ll need to secure a cashier’s check, which is guaranteed by the bank. Give yourself a few days before the closing to get this done, just in case you run into any issues.

9. Close

The hard work is over — now it’s time to seal the deal.

At your mortgage closing, you’ll meet with a group of people to sign your mortgage and (many, many) other documents. The house needs to be inspected, the deed or "title" of the house must be transferred, and so on.

Depending on state laws, the other people at the table may include your lender, your attorney, the seller and that person's agent and attorney, a closing agent, and a title company representative.

Make sure you review and sign all your loan documents, even though there’ll be a lot of them. If something looks different than you expected, don’t sign until you clear it up.

You’ll hand over that cashier’s check to cover the closing costs and other items, like prepaid interest, taxes and insurance.

Finally comes the best part: You grab the keys to your new home.

Find the Best Mortgage Rates to Fit Your Budget

Looking for a great mortgage rate? Don’t overpay on your home loan! Get updated mortgage rates, expert insights, and tips to lock in the best deal tailored to your needs. Save on monthly payments and make homeownership more affordable. Start your journey to savings now.