-1691069119.jpg)

Simplifi by Quicken review 2024

fizkes / Shutterstock

Simplifi by Quickenis a modern budget and money tracking app from the company that owns Quicken. Unlike the old-school desktop money app, however, Simplifi is a brand new app that runs on the web as well as iOS and Android devices.

Simplifi brings users a clean easy-to-use ad-free money tracking experience. However, there is a fee. And the app may not be perfect for everyone. Let's take a deeper look at Simplifi by Quicken and whether it makes sense for your finances.

Cost4

Customer service4

Ease of use 4

Tools and resources3.5

Synchronization4.5

Accessibility4.5

Quicken Up to 50% Off Sale

As of November 1, 2024, for a limited time, Quicken is offering discounted package prices.

- Simplifi Normally $71.88 per year, discounted price $35.87 per year

What is Simplifi?

Simplifi is a money tracking app from Quicken. The cloud-based app works on the web as well as most popular mobile devices. Unlike other free apps, Simplifi doesn't display any advertising. Instead, users pay a modest monthly or annual fee. Depending on your privacy and advertising preferences, that could be a refreshing change from ad-heavy alternatives.

Once signed up for Simplifi, you can view all of your bank, credit card, loan, investment and other financial accounts in one place. After logging in, you can view balances and recent transactions and how those purchases stack up to your planned budget.

But Simplifi does more than just help you track your money. Here's a look at some important features and how they may help you better manage your money.

What does Simplifi do?

When signing up for a new Simplifi account, you will be prompted to connect your bank and other financial accounts. Once securely connected, Simplifi slurps up your financial data from every connected account and aggregates it into one helpful dashboard.

You can track your net worth, income, total savings and store refunds, and set financial goals, among other features.

In my testing of the app, everything worked well. I never felt stuck or confused adding my bank and investment accounts or navigating the easy-to-understand menus and dashboards.

Simplifi by Quicken features

| Feature | Details |

|---|---|

| Price | $2.99 a month (limited time) |

| Budgeting | ✅ |

| Bill payment | ❌ |

| Investment tracking | ✅ |

| Access | Web Based, iOS, Android |

| Credit score monitoring | ❌ |

| Bill management | ✅ |

| Retirement planning | ❌ |

| Tax reporting | ❌ |

| Reconcile transactions | ❌ |

| Custom categories | ✅ |

| Import QFX, QIF files | ❌ |

| Two-factor authentication | ❌ |

| Online synchronization | ✅ |

Main features of Simplifi by Quicken

Simplifi has a decent list of features. Here are the main features to know about if you're thinking about signing up:

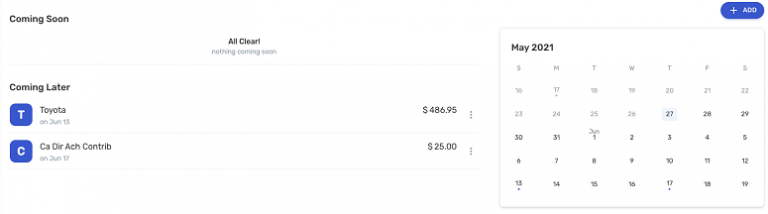

- Account and transaction tracking: The most important area of Simplifi is the dashboard. Here you view accounts and balances, your current spending plan, recent transactions, upcoming bills and other valuable financial metrics. The transaction tab keeps track of every single time money moves in or out of your accounts. Or enter transactions manually.

- Spending plan: A nicer way of saying “budget,” the spending plan section tracks your expenses to a monthly plan. You customize your budget with suggestions based on recent income and expenses.

- Bill-tracking: A calendar and list of upcoming bills help you understand what's coming due soon, so a recurring charge or withdrawal doesn't blindside you.

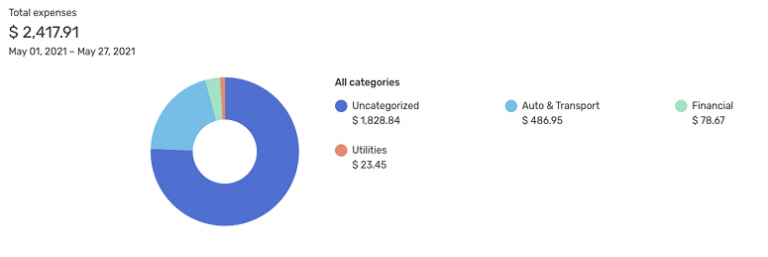

- Financial reports: The financial reports section includes graphical breakdowns of your spending, income, net income, savings and a monthly summary. You can also track refunds from stores to make sure they actually send the refund to your card.

- Investment details: The investment details page brings in a big list of all investment holdings from connected accounts. It shows only balances and today's price change. There's room for improvement here.

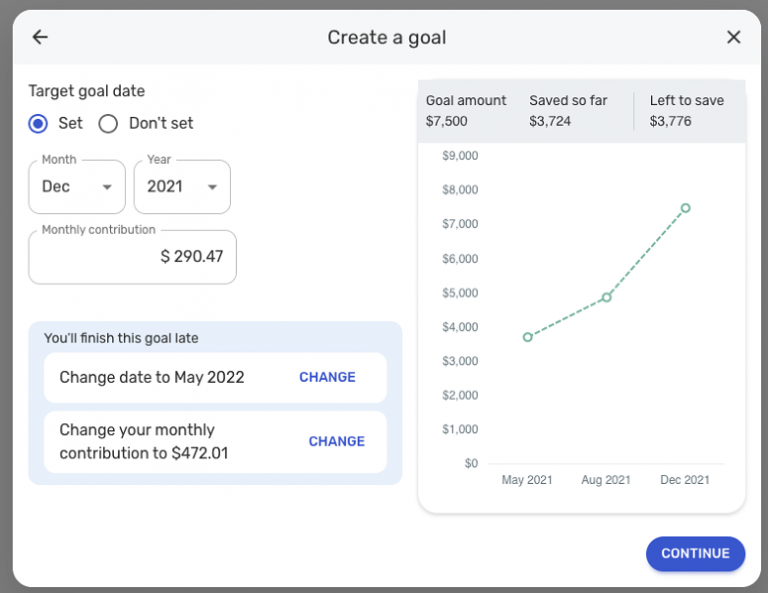

- Savings goals: Savings goals allow you to track progress toward specific goals like an emergency fund, down payment or major purchase. This useful feature ties into your budget, so you remember to set aside funds for your goals.

How does it work?

Every feature in Simplifi is straightforward and simple to use. To enjoy the full power of Simplifi, connect every possible financial account. Without complete data, your dashboard and reports are far less helpful.

Simplifi is an independent app from Quicken with it's own database. You can import data from Quicken or other apps using a CSV file but it won't import automatically. When you sign up at Simplifi, you're starting from scratch with a clean slate.

Simplifi currently supports banks and accounts located only in the US. Sorry, international friends.

Who is Simplifi for?

Based on the user experience and financial tools, Simplifi is best for people who want a clear overview of their money and to receive valuable tips to stay on target.

It's best for people who don't mind paying a little bit for an ad-free experience. This also improves the app's privacy and security, as you're not seeing suggestions from other companies based on your data.

If you are opposed to paying for a budgeting app, you'll need to look elsewhere as this one requires a subscription fee after a free trial period. But for many people, going advertising-free and getting the features they want makes it worth the discounted cost of $2.99 per month, billed annually.

Fees and limits

Simplifi gives you a free trial for 30 days before you're billed. You enter your payment card information when signing up and need to cancel before the billing date to avoid a fee if you decide Simplifi isn't for you.

The discounted subscription fee is $2.99 per month, billed annually. Once signed up, you won't pay any more than the subscription fee. And include as many financial accounts as you want, since there is no limit.

How do I open an account?

If you're sold on the features and want to sign up for a free trial, this is the signup process:

- 1.

Head to the Simplifi website or download the mobile app on your phone or tablet. Then just click the “start a free trial” button.

- 2.

When you click to sign up, you'll go through a simple set of onboarding steps where you enter your email, a password and billing information.

- 3.

After you're signed up, it's time to connect your financial accounts to start taking advantage of what Simplifi has to offer.

- 4.

It's easier than signing up for a bank or other financial product but a little more complicated than signing up for a social network. Overall, the signup process is easy and earns a good review.

How's the customer service?

Customer service is available only to users who are logged into the Simplifi platform. You can reach customer service from 8:00 A.M. to 5:00 P.M., Pacific Time, seven days a week via a messaging system.

According to Simplifi, they respond to most questions within a few minutes. In my test, I initially got an answer from a bot, but it was easy to click a button to “talk to a person” for human customer service. An actual human answered in about one minute. He was pretty nice too, considering my question was, “I just wanted to see if you really responded in a few minutes.”

Is Simplifi safe?

Simplifi uses bank-level security and encryption and I had no qualms handing over my login information. Simplifi connects to your banks and stores data using 256-bit encryption. I think that not even the NSA could break into your financial data with that level of security.

Simplifi pros and cons

Pros

-

Easy to use: The menus and tools are easy to understand, navigate and use even if you're not a financial pro.

-

Helpful financial info: Information (including spending plans, upcoming bills and goals) help you stay on track.

-

No advertising or upselling: You won't see any ads or product suggestions. Just your financial information and advice.

Cons

-

Subscription required: Unlike some competitors, there's no free version. You'll have to pay annually to use Simplifi after the free trial period.

-

Room for improvement in some areas: Investment features are minimal. And there's not much help for planning to payoff debt.

Best alternatives

- Empower: Empower is a free money tracking app with a focus on investments. Or pay a fee for investment management services.

- Lunch Money: Lunch Money is a newer financial app designed for people who want a numbers-driven advertising-free money tracking and budgeting experience.

| Highlights | Empower | Quicken |

|---|---|---|

| Rating | 4.8/5 | 4/5 |

| Budgeting | ❌ | ❌ |

| Investment monitoring | ❌ | ❌ |

| Retirement planning | ✅ | ❌ |

| Bill payment | ❌ | ❌ |

| Manual entries | ❌ | ✅ |

| Bill management | ❌ | ❌ |

| Reviews | Read Review | Read review |

Bottom line: Is Simplifi worth it?

At a discounted $2.99 per month (paid annually) is Simplifi worth it? There are good arguments either way.

Some people may prefer to save by choosing a free alternative like Empower. Others are happy to make a small payment to avoid ads and upselling and to get better customer service. If you are part of the second group, Simplifi is an excellent option.

Eric Rosenberg is a finance, travel and technology writer in Ventura, California. He is a former bank manager and corporate finance and accounting professional who left his day job in 2016 to take his online side hustle full time.

Disclaimer

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.