What is financial literacy?

Financial literacy refers to a basic understanding of essential financial topics and skills. You don’t need to learn how to run a business; it’s about personal finance, the kind that grows and shrinks your own bank account.

Concepts that fall under the financial literacy umbrella include saving, learning how to build credit, investing, paying off debt, retirement planning and more.

Keep in mind, financial literacy doesn’t just consist of knowing all the definitions. It's also applying that knowledge in the real world through smart money management.

Once you have the tools, your long-term financial success won’t be based on hopes, dreams and guesswork. You’ll know what you need to do to achieve your financial goals.

Why is financial literacy important for students?

At first, financial literacy might seem like a game for older people — individuals who are far along in their careers and have more disposable income than the average college student.

In truth, financial literacy holds particular significance for college students given their constrained financial resources. As many students are living on their own for the first time, they immediately grapple with the reality of housing insecurities. A recent survey suggested that 55% of Los Angeles Community College District (LACCD) students experience housing insecurity while 19% are homeless.

Many students are living on their own for the first time but don’t have cash to burn on simple mistakes. That turns budgeting and financial planning into urgent priorities.

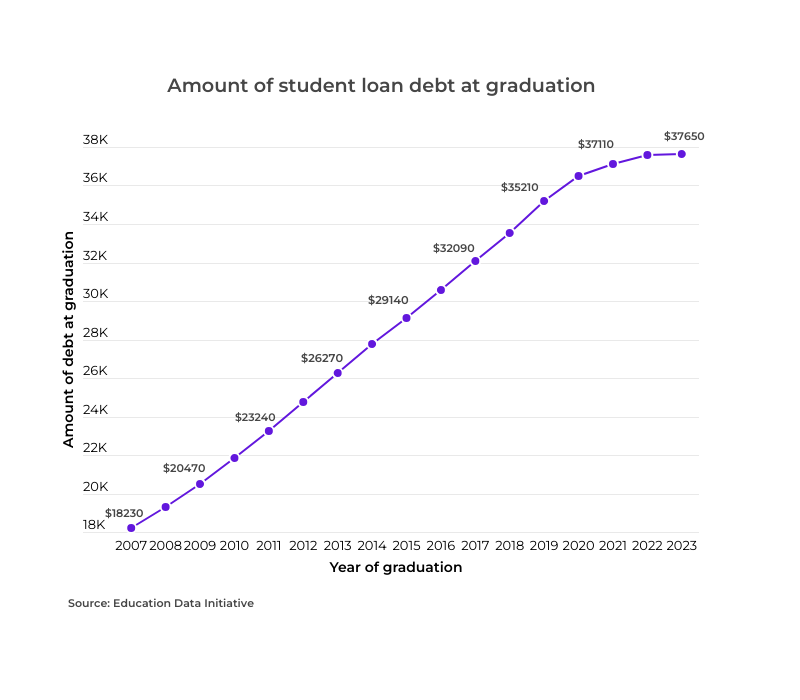

And it’s not like graduation brings immediate relief. Average student debt upon leaving school has skyrocketed to $37,650 — that’s up 322% since 1970, when adjusted for inflation.

A quarter of college students have experienced food insecurity, and 17% have experienced housing insecurity, a recent survey revealed

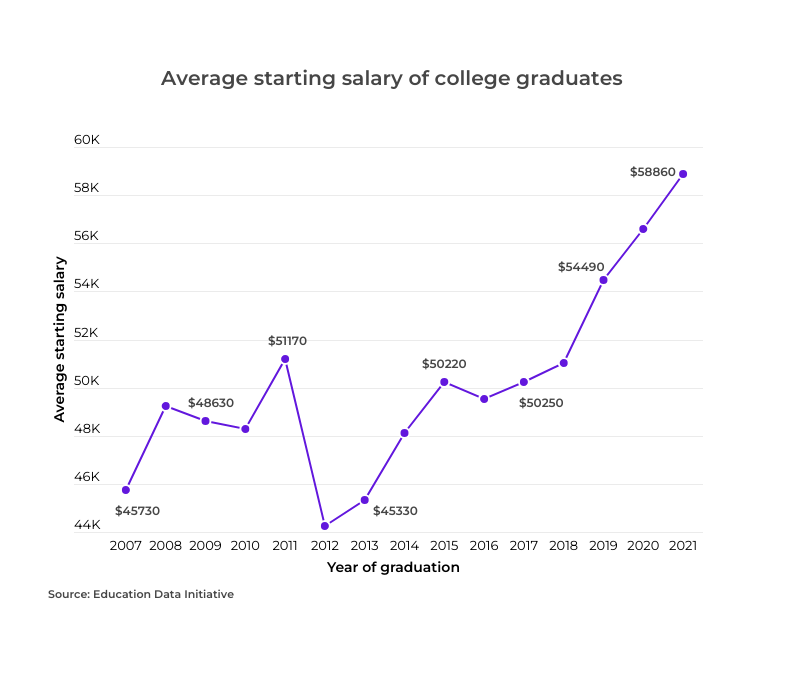

That looks like a lot of money for a recent grad — and it is — but you’ll be able to start mapping out a plan once you get an idea of your starting salary.

The average starting salary of bachelor’s degree holders over the past 10 years is $52,390. Obviously, a lot depends on your field. You can get a better idea of your individual prospects by searching for the job you want on the government’s Bureau of Labor Statistics website.

This will help you calculate your debt-to-income ratio, or DTI, which is a key budgeting and borrowing measurement.

To calculate your DTI, take your total monthly debt payments and divide the figure by your gross monthly income (how much money you earn each month before taxes and deductions are subtracted).

The DTI for the class of 2021 is around 63% — not as bad as the class of 2018 at 66%, but still a high DTI.

Lenders typically want to see this percentage much lower when it comes to approving loans, especially big ones like mortgages and auto loans, because it signals a higher likelihood of repayment.

A DTI of less than 43% shows you can handle your debts and will make it easier to get a reasonable loan.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn More5 pillars of financial literacy

Financial literacy covers a wide range of topics, but they can be sorted into five key categories.

Here’s a quick look at each one, touching on some of the most important elements you’ll want to learn about:

Earn

It’s not enough to know how much you make; you need to understand what happens to the money.

Say you apply for a summer job. Your employer will quote you a pre-tax salary, often through a written work contract. You’ll want to do the math to determine what that number will look like after federal taxes as well as other deductions including states taxes and Social Security contributions.

This will give you an accurate expectation of your net or take-home pay so you can budget accordingly.

Spend

Some spending is essential: You need to eat, get around, pay for school and keep a roof over your head. Some spending is not.

Your job is to correctly identify which is which, and to stay on budget while minimizing your costs and maximizing the value you get back.

Start by tracking your spending, either manually or with an app that watches your bank account. You can only make a decision about whether $150 a month is too much to spend on takeout if you know you’re spending $150 a month.

Then, take the time to really research your options. A lot of similar products and services are sold for wildly different prices — including food, clothes and insurance — and you should only spend extra when it makes you happier.

Save and invest

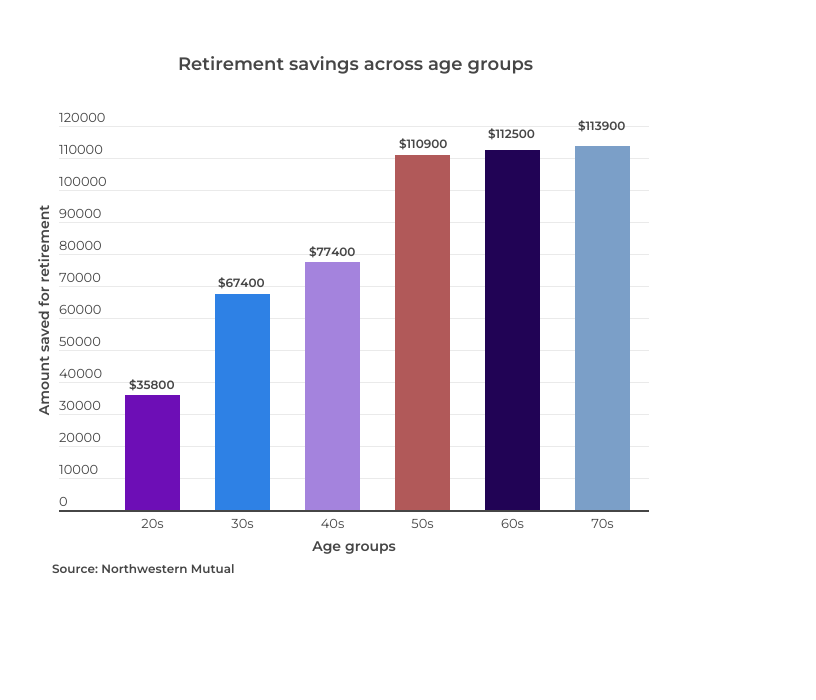

Many college students treat this as a problem for “later,” but you’d be surprised how quickly “later” can arrive. Saving and investing are not voluntary but critical to long-term financial stability and achieving your life goals.

The main goal now is to make saving and investing a consistent habit as you grow your earnings over time. A recent study by Northwestern Mutual shows how different age groups have saved up for their retirement — the average savings of U.S. adults rose by 3% in 2023, reaching $89,300 from $86,869 in 2022.

Plus, due to compounding, the saving and investing you do now is worth a lot more than the saving and investing you’ll do later.

Compounding happens when the interest you make in a savings account begins generating its own interest, or the earnings you make on your investments get reinvested and begin generating their own earnings.

This effect can ramp up quickly, even with a small amount of money. It’s starting early that’s the key.

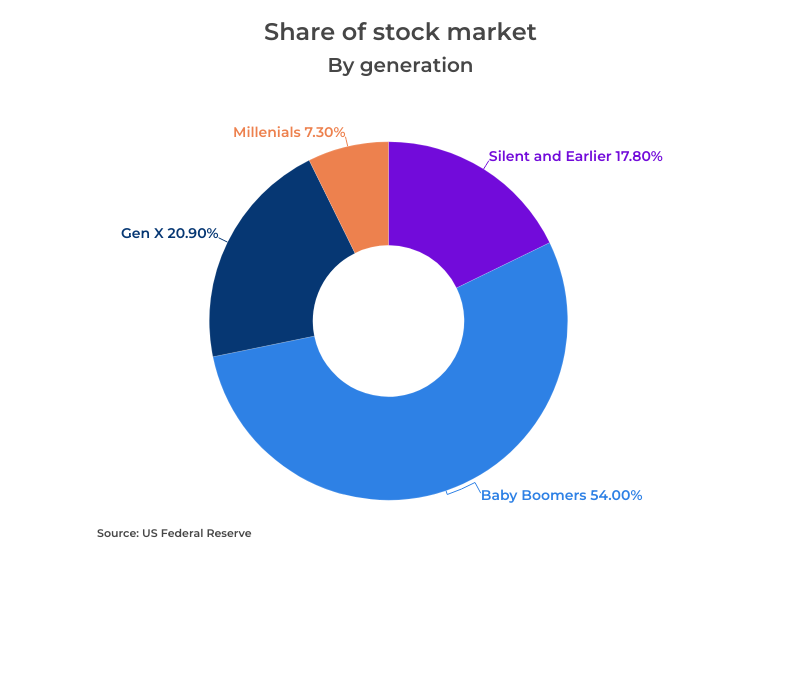

Millennials don’t own a very big slice of the stock market, data from the Federal Reserve shows, but don’t let that stop you from learning about different kinds of investments and putting any spare cash you have to work.

Borrow

Even if you’ve managed to pay for college without taking out huge student loans, you’ll likely borrow lots of money in lots of different ways throughout your life.

That includes mortgages for buying a home, auto loans for financing a car and credit cards for day-to-day purchases. Understanding how these loans work and what options are available will help you avoid major pitfalls.

Credit cards, for instance, offer convenience due to their widespread acceptance and ease of use, although they may come with higher costs compared to alternative borrowing options. Some loans are secured, which are cheaper but you must agree to surrender something of value if you stop paying. Some loans are closed, meaning you can’t simply pay them off quickly if you want to.

Take the time to determine the best kind of loan for your situation, then compare offers from different lenders. Pay close attention to the interest rate and how long you have to pay the loan back, and watch out for fees hidden in the fine print.

Protect

Making money isn’t easy, so don’t lose it to a catastrophe you weren’t prepared for.

Protecting yourself starts with an emergency fund — a set amount of cash you leave aside in your bank account for unexpected financial needs. That way, when your laptop gets stolen, you don’t need to borrow money (and thus spend more) to pay for it.

The other big element is insurance. Car insurance, renter’s insurance and health insurance will all drain your finances, but you’ll be glad you have them when you need them.

The key is picking the right kind and amount of coverage — so you’re not overprotected and overspending, or underprotected and underspending — and comparing offers from several providers. Different companies use different formulas to determine their rates, so you can save a lot just by shopping around.

11 statistics on financial literacy

Don't feel like a star student when it comes to financial literacy? The truth is that many Americans are lacking in this area, which can have a cascade of consequences for their financial well-being.

Take a look at these 11 statistics — and be inspired to do better than your classmates and neighbors.

-

Americans rank 14th in financial literacy globally.

-

Nearly 43% of Americans failed a National Financial Literacy Test.

-

The average score on the National Financial Literacy Test among people aged 19 to 24 is 64%.

-

70% of U.S. adults feel financial anxiety, and 52% say their financial stress has increased since before the pandemic.

-

In the past three months, 43% of women have reported an increase in concerns about their financial situation, which is 8% higher than the corresponding figure for men.

-

27% of millennials are doing better than their parents were at their age.

-

Approximately 19% of Gen X lack confidence in their ability to retire before reaching 80, and 11% believe that they may never retire.

-

About 27% of millennials have reported not being aware of their credit score.

-

Only 39% of college students answered over half of the five multiple-choice questions correctly, which covered topics like credit scores, loans, retirement savings, investing, and interest accrual.

-

88% of Americans said that high school did not adequately prepare them for managing finances in real-life situations.

-

Currently, 35 states in the United States have made it a requirement for students to complete a personal finance course as part of their graduation.

Earn cash back on what you buy most

Maximize your spending and earn up to 6% cash back on groceries, streaming, gas, and more. Whether it’s everyday purchases or splurges, this card puts money back in your pocket.

Learn more5 places to go to improve your financial literacy

Unless you’re born rich, you won’t be able to reach financial security without working on your financial literacy.

Now, if you haven't had any financial education until now — and that describes plenty of young people — you may not know where to turn.

There isn’t one right answer, so here are just a few of your options to get the financial knowledge you need.

Take finance courses at college

You're a student, so make the most of this time. If your college or university offers financial literacy courses, seize the opportunity to learn in a structured setting and maybe earn a couple credits.

If personal finance courses aren’t available, even something as broad as economics can prove useful in learning about topics such as inflation, stock market crashes and housing bubbles — all things that can have a very real impact on your life now and in the future.

Leverage government and nonprofit resources

While education is primarily a state and local responsibility, there are some federal resources available to all Americans.

The U.S. government has set up various platforms to help people learn about personal finance and get specific questions answered. MyMoney.gov, run by the U.S. Treasury's Financial Literacy and Education Commission, is a great starting point.

Other agencies include the Consumer Financial Protection Bureau, the U.S. Securities and Exchange Commission and the Internal Revenue Service.

Nonprofits are another option. For example, United Way sometimes offers free financial coaching.

Turn to financial institutions and experts

Banks and credit unions provide a wealth of financial information to customers and the general public. Check your bank’s website to see which services it has to help you, from article libraries to budgeting tools and calculators.

You can also consult financial professionals, either through your bank or independently, to help with tasks like setting up investment accounts.

Keep in mind: Not all advice is free, and not all advice is unbiased, so ask a lot of questions and compare with other resources before accepting what you hear.

Consider less traditional resources

Not everybody has the time or patience to take a class or poke around on government sites. Sometimes you want information to reach you where you are.

While social media is a swamp of bad advice, you can find people who really know their stuff.

Just do your due diligence when consulting online sources, and always look at a person's qualifications and background. Being on social media doesn’t mean someone is impartial, and having a lot of followers doesn’t mean they’re giving good advice.

Follow personal finance sites

Moneywise isn’t your only option, of course, but we try to provide easy access to tools and resources to help you master essential money matters.

We’re not know-it-alls — in fact, we try hard not to become know-it-alls. We’re always curious and always learning, and we like to take our readers along for the ride as we discover new ways to get the most from your money.

If you’re looking for well-researched articles that won’t make your eyes glaze over, head over to Moneywise or sign up for our email newsletter.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor.com can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning.

Try it now