Watch now: Full interview: Suze Orman and Devin Miller delve into why so many Americans aren't prepared for their next financial emergency

Use monthly expenses as an emergency fund barometer

If you’re following Ramsey’s “baby steps” to pay off debt, he also suggests you pause to set aside money for the unexpected. To calculate your emergency fund needs, first look at your monthly expenses over the last three to six months and come up with your average spending.

Gathering this statistic could help you avoid becoming a statistic. As of 2022, the Federal Reserve reported that 37% of Americans couldn’t even cover a $400 emergency expense without borrowing money, or selling something. That's up from 32% in 2021. So calculating your average monthly expenses can ground you in financial clarity in case of an emergency.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreConsider job stability and income volatility

Those in volatile fields or positions — independent contractors or commission employees, for example — know income can shift without warning. In such cases, emergency funds should cover a longer time horizon to factor for job or income loss, or a lack of financial stability.

A JPMorgan Chase Institute study found that on average, families experience large income swings almost five months out of the year.

If your income is inconsitent or your job uncertain, a good rule of thumb is to plan for three months of emergency savings for every 10% of income volatility.

Assess the range of risk factors

Beyond job uncertainties come personal ones that involve health, dependents, car repairs and home maintenance, for starters. The danger comes when you’re forced to pay these off with high-interest loans and credit cards, which can easily double or triple the initial charge.

Households with low liquid savings and high debt-to-income ratios will of course get hit harder when homefront pitfalls turn into financial ones. So the more possessions you own and responsibilities you have, the more you’ll need to save.

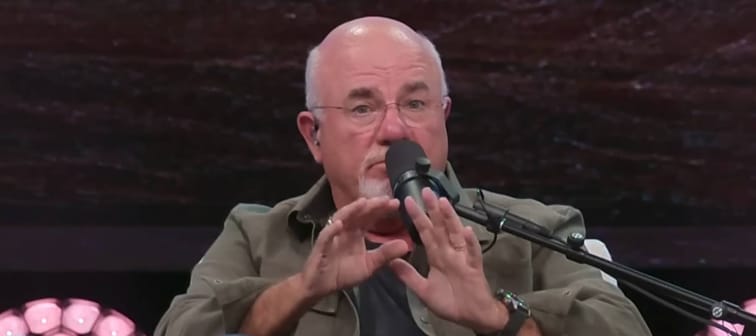

In the end, it comes down to being prepared. Take a cue from Dave Ramsey, who would no doubt approve of trading in a $1,000 benchmark for acting on million-dollar advice.

Earn cash back on what you buy most

Maximize your spending and earn up to 6% cash back on groceries, streaming, gas, and more. Whether it’s everyday purchases or splurges, this card puts money back in your pocket.

Learn moreGet your finances in shape

Having an emergency fund in place is crucial to feeling financially stable. But, as Ramsey himself would point out, that emergency fund doesn't do you much good sitting in your bank if you're still digging yourself deeper and deeper into debt.

While Ramsey recommends the snowball method — starting with your smallest debts and clearing them first to build momentum — if you've got lots of high-interest debt on say multiple credit cards, that can get expensive real fast. Due to compound interest, you can end up paying interest on your interest before you've cleared that account.

And with the average credit rate over 24% according to LendingTree, that interest can catch up fast. Depending on how much you owe and how many accounts you have, consolidating your various debts into a single loan could end up saving you thousands in interest.

These days, there are helpful online platforms make finding a personalized loan easy and efficient. By replacing your old loans with a single, cheaper one, you can keep yourself organized as you work to pay it off.

And if you want to get out of debt sooner and save even more on interest, you can choose a shorter repayment plan.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor.com can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning.

Try it now