SAVE-ing struggling borrowers

The SAVE plan aims to help borrowers who are more likely to struggle with repaying their loans.

According to the Department of Education (DoE), the majority of federal student loan borrowers in default originally borrowed $12,000 or less, hence that being the eligibility criteria for this wave of SAVE plan relief.

For every $1,000 borrowed over the $12,000 threshold, those enrolled in SAVE will get relief after an additional year of payments. For example, if you borrowed a $14,000 federal loan, you can get your student debt wiped out after making payments for 12 years.

The DoE estimates this fresh batch of relief will help nearly 153,000 borrowers with almost immediate effect. Others, who are eligible for early relief, but not yet enrolled in the SAVE plan, will receive a reminder from the DoE to sign up as soon as possible.

It is worth doing because all borrowers on the SAVE plan are in line to receive debt forgiveness after 20 or 25 years, depending on whether you have loans for graduate school.

Kiss your credit card debt goodbye

Millions of Americans are struggling to crawl out of debt in the face of record-high interest rates. A personal loan offers lower interest rates and fixed payments, making it a smart choice to consolidate high-interest credit card debt. It helps save money, simplifies payments, and accelerates debt payoff. Credible is a free online service that shows you the best lending options to pay off your credit card debt fast — and save a ton in interest.

Explore better ratesOngoing fight for debt cancelation

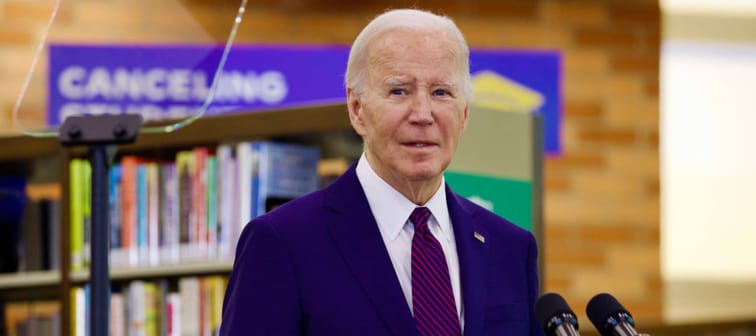

The Biden administration has now approved loan relief for nearly 3.9 million borrowers — and according to Cardona: “Our historic fight to cancel student debt isn’t over yet.”

Washington’s latest $1.2 billion debt wipe out follows a huge announcement on Feb. 15 whereby President Biden proposed expanding student debt forgiveness to those facing financial “hardship” — and giving the DoE the power to define that “hardship.”

The administration also wiped out $4.9 billion in student loan debt for 73,600 borrowers in January, by making fixes to the income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF) programs.

U.S. Under Secretary of Education James Kvaal said millions of student loan borrowers are counting on the Biden administration to “fix the broken student loan system and provide the forgiveness they earned and have been waiting for.”

He said the new SAVE plan relief demonstrates President Biden’s ongoing “commitment to student debt cancellation.”

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning. Try Advisor now.