What is portfolio analysis?

Portfolio analysis is when you study an investment portfolio to determine if it meets your investing goals and preferences. It's also a way to see if it meets the objectives you've set for your portfolios, such as risk, inflation, and performance.

Think of a portfolio as a carton that holds all of your investments. The total value of the carton is the sum of the market prices of your investments. But how do you measure the total risk of the carton?

You may notice that as events unfold in the markets, certain investments respond with sharper price movements than other investments. For example, when it rains, the price of a ride with Uber or Lyft rises, but the price of a television on Amazon is unaffected. The sensitivity of an investment to events unfolding in the market is carefully watched and measured by market professionals.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreHow portfolio analysis works

No doubt you have heard the expression, “Don't put all your eggs in one basket.” This is the idea behind correlation in portfolio analysis. If all your securities move in the same direction in response to market events, your portfolio's value may be wiped out by adverse developments. (It must also be said that the same portfolio could rise dramatically in response to positive developments.)

Not putting all your eggs in one basket means making sure that all your investments are not concentrated in the same sector of the economy. In other words, it's good for your securities to lack correlation. That way they do not all move in the same direction in response to an event.

When an adverse development comes along (such as COVID) some securities may suffer (stocks of airline companies for example). But others may do well (e.g., 10-year U.S. Treasury bonds). And the portfolio as a whole may preserve its value.

In this way, portfolio returns are optimized and risk is reduced.

So portfolio analysis consists not merely of selecting good securities but of selecting the right securities for your portfolio.

But this method of investing is not foolproof. During the 2008–2009 Financial Crisis most assets correlated. Stocks, bonds, mutual funds, ETFs, gold, commodities, derivatives and real estate all fell in price in response to the crisis.

Nevertheless, reducing the correlation among the assets in a portfolio is still the best method we know of for improving the odds of success and lowering risk.

How to conduct portfolio analysis

Fortunately, there are tools to help simplify portfolio analysis for investors. Here is a set of steps you can take to do a preliminary portfolio analysis. Or if you're using professional advisors, to ask more informed questions regarding their analyses.

Retire richer: The secret to building wealth faster

Most people miss out on key opportunities to grow their wealth. Partnering with the right financial advisor can help you secure a brighter future. Learn how to make your money work harder for you today.

Discover the secret1. Use a stock portfolio analyzer

You can gain insights into your portfolio by putting your investments into an online investment analysis tool. You may have to enter the data manually, though most will allow you to upload your data from a spreadsheet.

Some good online analysis platforms include Morningstar, Empower, and StockRover. Each of these platforms gives you the ability to track your performance and research stocks.

With Morningstar, for example, you can use their charts to analyze individual stocks or mutual funds and even input contributions to realistically track real-life investments. And Empower offers an Investment Checkup tool that analyzes your investments to make sure you are on track to meet your goals.

For those who want access to lots of analysis tools, Stock Rover provides customizable screeners, research reports, and more. It's also often possible to get portfolio analysis with a full-service broker like Fidelity.

These tools will display the assets of your portfolio by category. Stocks, bonds, and cash are asset categories, and so are U.S. and foreign securities. Categories such as industrial, high technology, and alternative energy are called sectors.

The terminology is not important. What you want to avoid is a concentration in any one category. Diversification improves your portfolio's ability to withstand shocks by lowering the correlation among assets (the extent to which they all move in the same direction.)

2. Evaluate how your portfolio performs as a whole

When you first look at your portfolio, look at it as a whole. How is it performing compared to other benchmarks? For example, you can look at other similar indexes or ETFs or even the broader market like the S&P 500. Or if you are investing in mostly tech stocks, compare it to the Nasdaq.

Look at other things as well, such as the price-to-earnings (P/E) ratio, the dividend yield, and even the expected growth rate.

3. Think about how Your assets perform individually

Evaluate your stock allocation

Examine your stock allocations in light of your personal circumstances.

- If your home is your largest investment, is it located in the same city as the company that is your largest stock holding? Perhaps some diversification would benefit you.

- What is the average price-to-earnings ratio of the stocks in your portfolio? How does that compare to the average for the S&P 500?

- As our markets are increasingly global, a mix of global and U.S. stocks may be appropriate. Seek allocation ideas from global mutual funds such as those offered by BlackRock, Morgan Stanley and Fidelity. See what they include and modify your portfolio accordingly.

- Take into account your personal views as well. For example, if you feel strongly about ESG investing or the consumer services sectors, you may wish to include or exclude companies engaged in certain sectors.

Evaluate your bond allocation

Bonds are commonly used in portfolios to generate income and provide stability. Many investors do not focus on the fact that the largest part of the return from fixed-income investments over time comes from reinvesting bond interest payments (or “coupons”). Have you made a plan for reinvesting those coupons?

Does your portfolio contain bonds that are trading at a premium but are subject to a call provision? It may make sense to review those positions to see if selling the bonds at a premium and reinvesting the proceeds at a lower interest rate could generate a higher return than if the bonds are called.

And the addition of small amounts of alternative investments may help stabilize the overall return of a portfolio. This is a concept known as the efficient frontier.

Evaluate specific funds

Many individual investors use mutual funds and ETFs as their portfolio assets. It's a good idea to measure their relative performance (versus their benchmark indexes). Also, check their absolute performance.

How long have the managers been in place? What are the Value Line or Morningstar ratings for the funds? Is there diversification among economic sectors? Are there large amounts of overlapping securities among your fund investments? You can determine this by examining the holdings of your funds to find out if two or more of your funds have the same security in their Top Ten holdings.

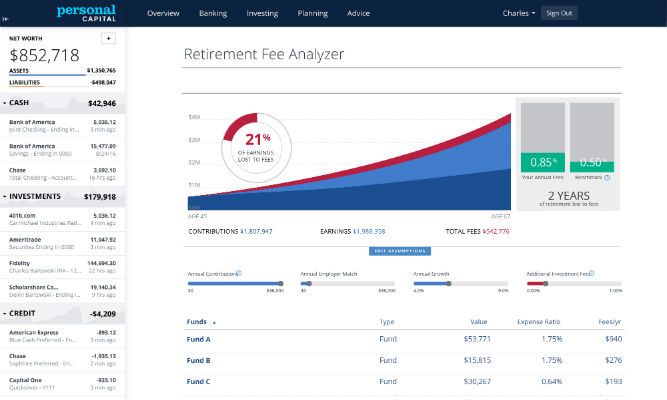

4. Evaluate manager fees

Fees are like blood pressure. They need to be kept low or they will silently kill your returns. That being said, if a fund is outperforming its benchmark index — after fees, consistently over time — there is every reason to pay premium fees for premium returns.

But it simply does not make sense for example to pay a hedge fund manager 2% of your assets under management (AUM) to underperform the Vanguard Admiral 500 Index Fund, which charges 0.04% of your AUM.

5. Think about your goals

Once you have examined your entire portfolio, as well as the individual components, it's time to figure out if they meet your goals.

First of all, you need to figure out what your goals are, as well as where you are in life. If you're closer to retirement, your asset allocation will probably be different from someone in their late 20s who has decades before they retire.

Also, keep in mind your own risk aversion. Ask yourself what economic developments you most fear. If it's a recession, then perhaps a more generous allocation of gold and bonds than stocks is in order. Or stocks that are less sensitive to the economic cycle.

The best portfolio analysis tools

We mentioned some stock portfolio analysis tools above, but here's a short and simple list of some of the best portfolio analysis tools on the market that you can try:

- Empower: An excellent all-in-one solution for analyzing your portfolio's fees, tracking net worth, and consolidating all of your assets under one roof.

- Morningstar: Its X-Ray tool is one of the best portfolio analysis tools out there, and it helps you ensure your asset allocation matches your goals and is balanced.

- Kubera: This is one of the best portfolio analysis tools and trackers if you have a variety of assets, including cryptocurrency. Just note it's more of a simple tracker and can't dig into fees like Empower.

- Stock Rover: Provides useful investment screeners and helps you forecast your portfolio's performance.

- Portfolio Visualizer: This software has a range of quantitative tools to help with backtesting and modeling, and it's an excellent option for more hands-on investors.

- Blooom: An excellent portfolio analysis tool to check up on your 401k.

For a free starting point, we suggest Empower or Stock Rover. More advanced traders will likely enjoy Portfolio Visualizer. And you can always test a variety of portfolio analysis tools to find the option that's best for you.

An example of portfolio analysis

Let's make our points clear by comparing two portfolios: A and B.

Portfolio A

Imagine that the investing in stocks and bonds in Portfolio A have an expected return of 10% and volatility of 10% next year. (This is determined by looking at target prices and beta and their weightings for each security on screening sites such as Yahoo Finance).

To estimate the range of expected return,

- For the downside, use return minus volatility: 10%–10% = 0%

- For the upside, use return plus volatility: 10% + 10% = 20%

So the range of anticipated return for Portfolio A is 0% to 20%.

Portfolio B

The returns of the securities in this portfolio are expected to be 16% and the volatility of the securities is 20%.

- for the downside: 16%–20% = –4%

- for the upside: 16%+ 20% = 36%

So the range of anticipated return for Portfolio B is –4% to 36%

Portfolio Analysis- A vs B

The range of potential return is greater in Portfolio B (–4% to 36%) than for Portfolio A (0% to 20%).

- A more risk-averse investor might prefer Portfolio A.

- An investor with a greater appetite for return might accept the greater risk exposure of Portfolio B.

The sheer amount of work involved in performing such calculations may intimidate any investor, much less a new one. But it is crucial to understand the concept that the behavior of individual assets often differs from the behavior of the portfolio as a whole.

Diversifying your portfolio lessens the correlation among the individual assets and buffers your investment portfolio when bearish developments occur. (Diversification will lessen the impact of bullish developments on the portfolio as a whole).

Metaphorically speaking, you must decide if you would prefer to sleep well or eat well. We recommend sleeping well.

Analyze, diversify and reposition your portfolio every year.

Further Reading: What is a bull market?

Final thoughts

When finance professionals speak of “active management” of portfolios they are referring to performing portfolio analysis and rebalancing.

In certain respects, portfolios resemble recipes. Using high-quality securities contributes to success just like using high-quality ingredients. But pay attention to how each security interacts with the rest of your portfolio. After all, even the finest cheese and chocolate may combine in unsatisfactory ways.

Portfolio analysis is a powerful tool for those seeking to raise returns and lower risks.

There is an element of chance in all markets. But it is not a game of chance. Past performance cannot guarantee future results. But it is the best guide we have to navigate the uncertainty of future markets. As famously noted by several of the world's most successful investors, “Luck is the residue of design.”

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor.com can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning.

Try it now