Investment trackers: 5 ways to monitor your stock portfolio

Fact Checked: Scott Birke

Updated: February 09, 2024

Once you start investing, it's exciting to track your portfolio and its progress. It makes a lot of sense; you've started a new aspect of your finances and want to keep an eye on things. In the last few years, a lot of new investment trackers and portfolio tracker services have cropped up that provide various ways for you to track your investments.

Some platforms offer you the chance to invest and track your portfolio. Others offer educational options and tools. Still, others just reflect your investment choices. Which are the best stock tracking apps and methods that suit you? Let's find out what kinds of tools are out there for you to use.

1. Use online tracking services: robo-advisors and brokerages

Robo-advisors and apps are getting more popular for money and investment management, especially with a younger demographic who have grown up with technology. There are a lot of options, so how can you find the right app for you?

Recommended robo-advisors for investment tracking

| Highlights | Betterment | Wealthfront | Ellevest |

|---|---|---|---|

| Rating | 4.5/5 | 4.5/5 | 4.5/5 |

| Minimum to open account | $10 | $500 | $0 |

| 401(k) assistance | ✅ | ❌ | ❌ |

| Two-factor auth. | ✅ | ✅ | ❌ |

| Advice options | Automated, Human Assisted | Automated | Automated |

| Socially responsible investing | ✅ | ✅ | ✅ |

| Sign up | Sign up | Sign up | Sign up |

| Review | Betterment review | Wealthfront review | Ellevest review |

How to compare stock portfolio trackers

- Start with fees — Make sure you understand clearly what kinds of fees you pay with each app, and how much that adds up to each year. Each app has its own fees. The amount you pay in extra fees can make a big difference to your investments over time. The more you pay, the less money you have in your investments.

- Account minimums — Some apps require that you start investing with a specific amount of money. You may need $500 or $3,000 to get started. But many of the apps have no account minimum requirements to get started. That means you may be able to start investing in certain funds with just $5 a month.

- Risk tolerance — Apps often come with a short quiz to help you determine how comfortable you are with risk in the stock market. Each app has its own algorithm to figure this out. However, a short questionnaire isn't really a thorough enough look at your investment goals and risk tolerance. It doesn't really make sure you understand what you're putting your money into. Look for an app that also offers educational resources and a place for you to ask questions or easily change the asset allocation they set you up with. You can learn more about asset allocation here.

A one-stop investment tracking shop

Most of the best robo-advisors will have a feature that shows you your investments and lets you track your portfolio performance. You can see the deposits or withdrawals you've made with your investments and also their behavior. Some will display this in a chart or graph to make it easy to understand.

For someone looking for a one-stop-shop, this could be a great tool. Rather than doing your investing in one place and your tracking in another, you can see it all in one place. Note that since robo-advisors are primarily investment tools, their tracking features may not be as robust as you would like.

Traditional brokerages offer similar insight. Vanguard, for example, shows you your chosen stock's daily performance, and you can see your contribution history at any time. This is a good oversight but lacks the depth and nuance that some other platforms can offer.

2. Investment tracking with personal finance apps

You can also use an online budgeting tool that is offered by specific platforms to track your investments.

Empower

Empower is one of the biggest budgeting apps around. Their investment tracker is one of the most powerful on the market.

Empower is all about charts and graphs. The app creates graphs or charts of your investment performance. It compares your investment performance to a stock market index, to see how your portfolio would have performed in the past. It also makes recommendations for your investments based on your information and risk tolerance. The app also shows you a multitude of other options, including what your investments would look like if you had bonds. You can then compare that to what you currently have and make investment decisions from there.

You can also track your cryptocurrency investments. You will need to manually input the information but once added, you can view your crypto investments alongside your other portfolios, to get a full picture of your investments.

Empower offers a tool called “Investment Checkup” where you can compare your current asset allocation against their algorithm's advice to see how you measure up.

Stock Rover

Stock Rover is a specialized stock screener and investment analysis tool that gives intermediate to advanced investors a major edge with their detailed charting tools and research reports. Unlike others on this list, Stock Rover is not a budgeting app that happens to offer portfolio tracking. Instead, it's a robust platform of charting and analysis tools to offers a full data-driven snapshot of how your portfolio is performing, relative to different benchmarks, risk metrics and time horizons.

Stock Rover is compatible with over a thousand different brokerages, so connecting your accounts and importing your data is made super-simple. And once you're on the platform, you have access to detailed portfolio analysis, applying as many different screeners as you want and received through automatic portfolio reports.

One cool feature is that Stock Rover can project your future dividend income based on the different stocks, ETFs and mutual funds that you invest in. It also offers data-backed Future Portfolio Performance Simulations. So if you're at, approaching, or planning to hit Coast FI, you can get an accurate idea of your monthly income from your investments and when you can comfortably retire.

CountAbout

CountAbout is a handy budgeting and personal finance tool. While it's mostly focused on monthly budgets and helping you monitor your spending, they also have a FIRE widget to help you plan for retirement.

Short for Financial Independence and Early Retirement, FIRE tools help you track how close you are to retirement. CountAbout's FIRE widget that tracks your monthly expenses along with any potential passive income and plots them over time. So, for example, if you are mostly invested in stocks, it will show the potential amount you have versus your expenses so you will know when you are financially independent. You can also analyze your future finances by setting your retirement withdrawal rate and calculate your passive income potential from the size of your assets.

SigFig

SigFig is a registered investment advisory service. They offer free investment tracking, and you can opt to have them manage and review your assets (free for your first $10,000 invested and then a 0.25% annual fee after that). SigFig can automatically analyze and monitor your investments. You also have the option for them to automatically rebalance and diversify your investments.

Their aim is to do so while reducing risk and minimizing the fees you pay. This is a very attractive service for new investors as they learn about their investment goals and how to track their money. For serious and well-versed investors, the interface may be too simplistic and the investing features not robust enough.

Morningstar

Morningstar is a market and investing research and education platform. On their site, you can see the stock performance and also find educational articles and seek advice. It's a great platform to keep track of market performance. And you can find information from experts to understand what you're seeing.

You can also set up online portfolios. Morningstar has a special feature called “X-Ray,” which gives you the opportunity to enter your mutual funds so you can see your portfolio holdings broken down by the underlying stocks within each of those funds.

This is a really powerful way to see what you are investing in, as well as a way to track performance over time. It's also something that differentiates Morningstar from a lot of other investment tracking tools.

Seeking Alpha

Seeking Alpha is an investing community that features crowd-sourced content and provides a robust suite of stock analysis tools. information. Users can choose from three plans: Basic (free), Premium ($19.99 per month) and Pro ($69.99 per month).

The Basic plan includes access to newsletters, stock charts, Wall Street ratings for stocks, and more. Premium unlocks several first-party Seeking Alpha tools like Stock Quant ratings and performance ratings. Pro subscribers, meanwhile, get a completely ad-free experience and are able to access Pro-only content and newsletters.

3. Create a DIY portfolio tracker with spreadsheets

You can also decide to keep track of your investments yourself using Excel or Google Sheets. These allow you to customize your own spreadsheets to track your investments. This is a lot more work than using a preexisting program but has the added benefit of being completely customizable.

Spreadsheets are also useful for their help with investment calculations and projections. You can use formulas to calculate dividend income or forecast investment projections over time. And if you're interested in FIRE (financial independence, retire early), you can use your spreadsheets to track your investments and your timeline.

Excel

Excel is part of the Microsoft Office suite, so you'll have to purchase that. Once you have Excel, it's a powerful tool for tracking your investments. Excel has a deeper formula and functions capacity than Google Sheets. So, you can do more to customize your Excel spreadsheets than your Google Sheets. In fact, Excel simply has more capacity for data; if you're looking to import 15 years' worth of data, Excel is the way to go.

On Excel, you can manually insert functions, insert using the “insert function” button, or select one from the formulas tab. A few common formulas for investment tracking are:

- =DAYS, which calculates the number of days between two dates and can show your portfolio progress over time

- =AVERAGE, which calculates the average of a set of numbers

- =MAX and =MIN, which will pull the maximum and minimum numbers from a set, respectively

Google Sheets

Google Sheets comes free with a Gmail address. Sheets are easy to use on the go, as you can edit them from any computer that has internet access. (For Excel, you must have the file and program downloaded onto whatever computer you're using.)

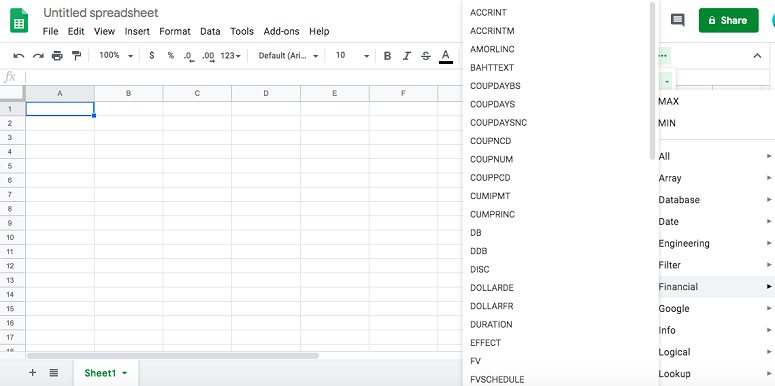

In Google Sheets, you can click on the Functions tab and select “financial” functions to be shown a list of formulas you can use.

Some helpful formula options in Google Sheets are:

- ACCRINTM, which determines accrued interest security pays at maturity

- INTRATE, which calculates the effective interest rate

While the major downside to either Excel or Google Sheets is you have to manually input your investment data, spreadsheets work very well for tracking and comparing data. Once the numbers are in the spreadsheet, you can use formulas to add up your investments over time, and you have a handy place to see your investment history in one go.

4. Use desktop apps for investment tracking

Another option is to use software on your computer as a portfolio tracker. There are a couple of different options you can use, including Excel mentioned above.

Quicken

Quicken is a powerful tool to track your investments. It keeps you updated on your own finances and what the stock market is doing in general. You link your Quicken account to your brokerage account, and it downloads any income and expenses from your investments. You can use it to track investments, dividends, and return on investment (ROI).

Quicken stores your data on your computer and not on a remote server, which makes it very safe. You can search for and update individual stock and fund prices using the ticker symbols in the program. The same index-tracking system provides users the latest available market prices, as well as the latest news headlines about the investments you track. This means you can be up to date on the market and make fast decisions about your investments.

Using Quicken, you can easily see all your portfolio fees, which can help you determine your true rate of return.

QuickBooks

You can't track your investments directly with QuickBooks Pro. Instead, you'll have to track them through what is called an “asset account” on the platform. Since QuickBooks is designed for business accounting and not personal finances, it isn't nearly as robust as some other options. To add an asset account, click on the “Chart of Accounts” tab and then “Add new account” and select “asset account.”

With QuickBooks Online you are able to track personal money you use to pay business bills or fund your business. (This is called a capital investment.) You'll need to link up a bank account to track these.

5. Start using a trading journal to track your stock portfolio

A trading journal is a log in which you keep track of what trades you make, your reasons for making them, and their outcomes. It can be as uncomplicated as writing everything down in a dollar-store binder, or it can involve using in-depth software.

Trading journals are particularly popular with traders who focus on complicated trades, such as those on the foreign exchange market (forex). But anyone who wants to play the stock or options markets can benefit.

Now, one of the biggest misconceptions about a trading journal is that you use it just to log which trades you made and whether or not you profit. That's not the point.

The point of a trading journal is to help yourself become a better trader. It's not about giving yourself a pat on the back when you do something right. It's about learning from both your successes and your mistakes. It's about analyzing what you've done so that you can perform better in the future.

Related: How to trade stocks

What do you put in your trading journal?

There are several great software solutions for keeping a journal, but let's start you out the old-fashioned way, with some loose-leaf paper in a binder. I recommend using a binder because you can easily store other materials related to your trade (we'll get to that in a minute).

Here's what to write down for each trade:

- The date and time you entered the trade

- The name of the stock

- The ticker symbol for that stock

- How many shares you purchased and your reasoning for choosing that amount

- Whether this is a long or short position (if this is new to you, check out this article)

- Why you entered the trade (did you use any particular systems?)

- Where you placed any stops, if applicable

- The date and time you left the position

- Your reason for closing the trade

- The percentage gain or loss that you realized from the trade

- Any feelings that you had about the trade before initiating it and while it was open

- Your thoughts on closing the trade — in particular, what you would have done differently

Those last two items can be the hardest. After all, they sound a bit too touchy-feely for a lot of us. But you need to be completely honest with yourself so that you can properly analyze your trading patterns and control your emotions. What gut feelings did you have that led you to make the trade? What did you hope it would do? What were your worst fears regarding the outcome of the trade?

Other things to include in your trading journal

There are other items you'll want to include in your trading journal. Here's where using a binder comes in handy.

Before and during your trades, print or cut out and save anything you may have come across that influenced your thinking in regard to this position. It can be a blog about this one particular stock… or it could be a newspaper article about an event that might affect an entire industry. Anything that you found during your research.

The idea is to save anything that influenced your trade so that you can analyze your own trading systems.

Using your trading journal

Although the process of recording all of this information alone can be a helpful exercise, the real importance of keeping a trading journal comes in reviewing it.

Every week, sit down with a cup of coffee in a comfortable chair and review your journal. In particular, look for patterns. Which days of the week are stronger for you — if you're panicking and selling out on Mondays and Fridays, you may be having trouble with liquidity. After all, those can be days when the volume can be at its thinnest.

Other things to look for include:

- Do you have more success with short or long trades?

- Are you adjusting your trading system to low-priced stocks versus higher-priced ones?

- Are there certain times of the day during which you have more success?

- What types of alerts or reports are more likely to affect your trading action?

- What's the most comfortable trade size for you?

Finding answers to these and other questions from analyzing your trading journal can help you create and implement a successful system.

Tracking your investment portfolio is just the beginning

Which app and tracking system will work best for you depends on what kind of portfolio you have and where you are in your investment journey. Different types of investors will be best served with different platforms.

What matters most is finding one that works for you and that you enjoy using. The more your investment accounts feel like fun (or at least something you like), the more inclined you'll be to take charge of them. The more they feel like homework, the less likely you are to stay on top of them.

Ignoring your money could mean opportunity costs, paying extra fees, or simply not understanding your money as best you can. Take your time and find the investment tracker that works best for you.

Kara Perez is a freelance personal finance writer.

Best investing guides

Disclaimer

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.