The short version

- A centralized exchange is a crypto trading platform that facilitates transactions between users and the blockchain.

- A decentralized exchange facilitates trading peer-to-peer using smart contracts.

- For users just getting into crypto, a centralized exchange is more user friendly but costs more. Decentralized exchanges are cheaper but can be more confusing to navigate.

What is a centralized exchange?

A centralized exchange, or CEX, is a crypto trading platform that acts as a middleman between users and the blockchain to facilitate smoother transactions.

CEXs are like banks. They provide storage for your crypto assets, customer support when you need it, security, monitoring, and sometimes even investing advice – all for a small percentage fee commonly harvested as trade commissions.

You’ve probably already heard of the most popular centralized exchanges like Binance, Crypto.com, Kraken, Gemini, eToro, and FTX.

More: The best crypto exchanges

What is a decentralized exchange?

A decentralized exchange, or DEX, cuts out the middleman and facilitates direct, peer-to-peer crypto trading via smart contracts.

So if a CEX is like Chase Bank, a DEX is more like Venmo. It's less of an entity and more of a slick piece of tech that enables P2P trades and otherwise stays hands-off.

Today’s more popular decentralized exchanges include SushiSwap (aka Sushi), Uniswap, Curve Finance, Pancake Swap, and Venus.

Centralized vs. decentralized: key differences

Popularity

Due to their marketing budgets, user-friendliness, and the capital backing them, centralized exchanges are significantly more popular than decentralized exchanges and handle most of the crypto trading volume.

But their lead is shrinking.

Many crypto fans think DEXs are the future. In fact, DEX activity is skyrocketing. Over $1 trillion worth of crypto swapped hands on DEXs in 2021, an 858% spike over 2020 activity.

In the past, DEXs have been critiqued for having too low trading volume with not enough buyers and sellers on the site. But that seems to be changing.

Security

Right off the bat, there’s a common misconception that centralized exchanges are the more secure option. After all, features like 2FA, user verification, and customer support must make for a safer trading environment, right?

In reality, these third party elements can lead to more points of failure–as well as potential entry points for hackers and scammers. Plus, if a CEX fails or simply disappears, your crypto typically disappears with them (that’s how I lost all my DOGE).

By contrast, DEXs never take custody of your crypto. Instead, they allow users to connect their own crypto wallets. So you keep full control of your assets when you use a decentralized exchange which a major reason that they’re often considered a safer option. But that doesn't mean that they're completely invulnerable to hacking.

Now, some would be quick to point out that DEX funds are unrecoverable, whereas many centralized exchanges have begun insuring their users’ deposits. That’s a fair distinction, but remember; stolen crypto is extremely difficult to pay back.

Mt. Gox was hacked in 2014 and most victims have yet to be reimbursed.

Regulatory oversight

Regulatory oversight is the chief dividing line between centralized and decentralized exchanges.

Simply put, centralized exchanges put their fingerprints on every transaction – they host order books, open accounts, and even take custody of users’ crypto. Therefore, they have to register as exchanges with global regulatory bodies, as well as follow KYC requirements like a bank (read: collect detailed user info and track their activity).

CEXs that don’t follow the rules get in big trouble.

In stark contrast, decentralized exchanges are hands-off by design/ They leverage smart contracts to facilitate P2P trades within the blockchain itself.

That tech-savvy sleight of hand has been enough to throw regulators off the scent for years, but that’s changing. Before leaving in 2019, the SEC’s first Chief of Cyber Unit said this:

Using any blockchain to create an exchange without central operations doesn’t remove the original creator’s responsibility.

So, as it stands in 2022, both types of exchange can be regulated – it just seems that centralized exchanges are the bigger, easier target for the SEC.

Usability

Generally speaking, centralized exchanges are much more user-friendly than decentralized exchanges.

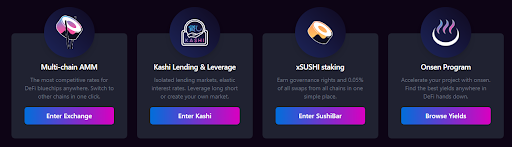

DEXs typically cater to more grizzled, experienced crypto traders with fluency in advanced terminology. Case in point, here’s a clip from Sushi’s homepage:

DEXs expect that you know what these terms mean–and can also navigate a more complex, detail-rich UI.

In stark contrast, centralized exchanges embrace users with little to no prior crypto knowledge. They have intuitive, beginner-friendly interfaces, and most have expansive back catalogs of educational material.

Coinbase will even pay you to learn about crypto. How usable and beginner-friendly is that?

In short, while the centralized exchanges are trying to flatten crypto’s learning curve as much as possible, DEXs continue to offer a black diamond experience–and they know it.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreCrypto selection

Decentralized exchanges grant access to most, if not all cryptocurrencies in existence.

Centralized exchanges, on the other hand, offer access to a curated list.

In this respect, one is not objectively better than the other. If you’re new to crypto, you might prefer knowing that the crypto’s you’re browsing have been thoroughly vetted by a professional third party.

But if you’re more experienced, you might prefer having access to all cryptos so that you can get it on the ground floor of the next promising altcoin.

Fees

As you probably could’ve guessed, decentralized exchanges have lower fees. By automating most of their processes, DEXs have fewer overhead expenses that get passed down to the end user.

To illustrate, centralized exchange Coinbase charges between 0.5% and 4.5% commission per trade. One of the more popular decentralized exchanges, SushiSwap (aka Sushi), charges just 0.3% per pair.

Speed

Here’s another one that might surprise you; despite their low overhead and seemingly streamlined operations, DEXs are actually the slower of the two.

DEX trades happen in real-time on the blockchain, requiring up to ten minutes to match and fill. CEX trades, on the other hand, can happen almost instantaneously due to the platform’s liquidity.

Centralized vs. decentralized: which is right for you?

You might prefer a centralized exchange if:

If you’re looking for an effortless on-ramp experience, easy-to-use tools, and value having your altcoins pre-vetted, you’ll be very happy with a centralized exchange. The speed, simplicity, and convenience of using a centralized exchange is what attracts the majority of crypto traders.

You might prefer a decentralized exchange if:

If you’ve been trading on a centralized exchange for a while now, and feel experienced and confident enough to break out on your own (essentially), making the leap from CEX to DEX may be the right move.

Decentralized exchanges remove the guardrails, but also the fees and limitations, and drop you right into the blockchain. If you’re ready for it, you’ll be very happy trading through a DEX.

Retire richer: The secret to building wealth faster

Most people miss out on key opportunities to grow their wealth. Partnering with the right financial advisor can help you secure a brighter future. Learn how to make your money work harder for you today.

Discover the secretThe bottom line

Will decentralized exchanges eventually overtake centralized? Probably not. I predict that just like Amazon and brick-and-mortar retail stores, both options will continue to coexist. And that’s a good thing, since it gives us a way to leverage both for their respective advantages.

Although a CEX or DEX might be a better fit, you don’t really have to choose between the two; you can manage a CEX account for learning and simple trades, and leverage a DEX account for digging up obscure altcoins or dodging fees.

Securities trading is offered to customers by eToro USA Securities Inc (“eToro”), a broker dealer registered with the Securities and Exchange Commission (SEC). Investments are subject to market risk, including the possible loss of principal. Crypto Trading is offered via eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor.com can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning.

Try it now