Why should investors invest in funds?

The keys to successful investing fall broadly into two categories: learning and researching.

Learning what you need to know to be a successful investor isn't impossible. But some people simply aren't cut out for it. Worse still, their psychological makeup might actively sabotage their investing by causing them to frequently sell low and buy high.

Another significant hurdle is the time commitment needed to research and manage a portfolio. People with families or who work long hours may simply not be able to invest the necessary time.

That's where funds make the most sense. You are practically outsourcing your investment decisions to a professional. SEC laws forcing mutual funds and ETFs to be transparent. So investors can easily find investment managers that fit with their tastes and styles.

Discover how a simple decision today could lead to an extra $1.3 million in retirement

Learn how you can set yourself up for a more prosperous future by exploring why so many people who work with financial advisors retire with more wealth.

Discover the full story and see how you could be on the path to an extra $1.3 million in retirement.

Read MoreBeating the pros at their own game

Investors willing to put just a bit more effort into their fund investing may stand to significantly boost their performance. They can even beat out the fund managers they wanted to invest with.

This is all possible because mutual fund and ETF managers must by law list all of their funds' holdings. Mutual funds must list all of their holdings and any changes on a quarterly basis. But ETFs provide fresh updates daily. This makes them uniquely positioned for this investment strategy, so we will continue by focusing on ETFs.

As ETFs have billions of dollars to invest, managers don't just buy stocks in one go. Instead, they generally scale into investments that they are bullish on and slowly diminish the size of their investments they are losing confidence in.

Investors with a keen eye can quickly spot this trend as it develops. If an ETF has opened a brand new position, the odds are good that it will buy more over the coming days, weeks, and months. This gives nimble independent investors a great opportunity to buy in first and outrun these investment giants.

There are a number of strategies small independent investors can use to outperform their target ETFs.

Size does matter

Each ETF must post changes to their holdings daily. So investors know what each is invested in and what percentage of their portfolio each investment makes up. And many ETFs have so much money, they can't have concentrated portfolios like retail investors might. But they have a team of professional analysts to cover many different stocks.

This allows many ETFs to hold positions in dozens of different stocks, something the average retail investor just wouldn't be able to keep up with effectively.

But this doesn't mean the fund manager has the same level of confidence in each of his or her investments. In many cases, an investment manager may be most confident in only their top five holdings. But due to size, they can't invest all of their cash in those five stocks without adversely moving the price of the stocks.

That's why we see many ETFs with 20–100 positions but with the top 20 making up the majority of the portfolio and the rest making up only a tiny percentage.

This leads to many ETFs following the Pareto principle: 80% of their gains come from just 20% of their positions. With some ETFs, the result is even more extreme with 90% or more of their gains coming from just 10% of the stocks in their portfolio.

This liquidity restriction for large funds is an opportunity for smaller investors. As mentioned above, many times a fund manager may have most of his conviction in a minority of his positions. This is generally seen by how much weighting each position is given within a portfolio. Investors can easily see this on the ETF's information page. This weighting shows investors what stocks the fund manager is most bullish on.

But your portfolio doesn't need to be that large

Rather than buying dozens of stocks, an investor can create a more concentrated portfolio that will track an ETF without the limitations imposed on fund managers. A smaller portfolio is far easier to manage and track. And it can also lead to an increased upside as investors will have a higher weighting of those high-conviction stocks.

This in itself is a powerful strategy to outperform actively managed ETFs with minimal effort. But combining it with our next principle is what can lead to massive long-term outperformance.

Diversify your portfolio by investing in art

When it comes to investing, a diversified portfolio can lead to better returns. Masterworks' art investing platform has turned a previously inaccessible asset class into an actual option for individual investors. Think of artists like Banksy, Monet or Warhol. Get priority access and skip the waitlist here.

Skip the waitlistManagement fees: what is the damage?

“democratization of finance”: The promise that all households can make money and/or manage risk by buying appropriate financial services products

There has lately been a growing trend to push for lower and lower management fees. A few decades ago mutual funds charged high management fees regardless of performance. But today a combination of increased competition from ETFs, lower commissions, and higher demand for the democratization of finance (see sidebar) has led to a steady trend in fee reduction.

This is seen mostly in the passive index-tracking space, where the largest index ETF, the SPDR S&P500 ETF (SPY) charges an annual management fee of just 0.0945% compared to a mutual fund that tracks the same index and generally charges around 0.55%.

This is great for investors who invest in passive index funds. However, in specific niches fees are still comparatively high. Take for example the iShares ETF tracking microcaps, which has a management fee of 0.60%.

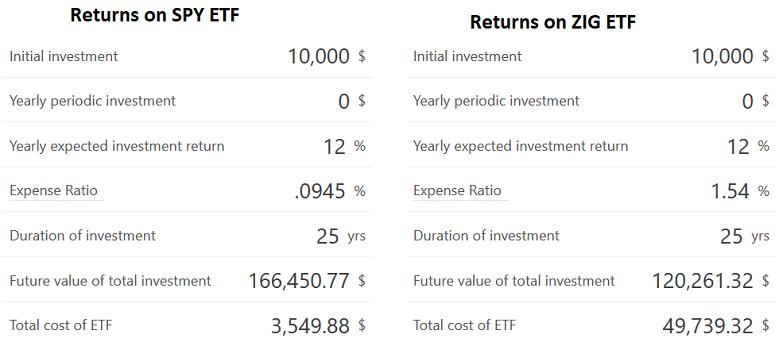

Comparing fees of two ETFs

For actively managed ETFs, management fees are much higher than their index-following cousins. For example, Acquirer's Fund ETF (ZIG), which looks for deep-value stocks, has an expense ratio of 1.54% — 16 times the annual SPY fee of 0.0945%.

This is an important benefit if you track actively managed ETFs. As gains compound so does this annual fee amount. Over a long period of time, high management fees can cause the fund to underperform the stocks in its portfolio. For illustration, compare the growth of $10,000 over 25 years at 12% annual growth with SPY's 0.945% fee and ZIG's 1.54% fee.

Comparison of returns after fees over 25 years, SPY vs. ZIG(Source: Omni Calculator's expense ratio calculator for ETFs)

As you can see, you would be nearly $50,000 richer with the smaller fee. And that's just on $10,000. Imagine the difference when you invest more.

These results, of course, don't account for inflation or taxes, but it illustrates the point. The longer you are invested in a fund with a high fee, the more you stand to lose. Over a single year, the difference will be negligible, but over time these fees eat more and more of your returns.

And this gives us a great chance to benefit by mirroring the top of holdings of an actively managed ETF without having to pay the management fee.

Essentially, you're letting the fund manager do all the work and riding their coattails free!

Example: ARKK

To really drive home how regular investors can beat active ETF managers at their own game with minimal effort, we're going to use one of the market's hottest ETF companies: Ark Invest. CEO Cathie Woods has become a superstar investor. So using Ark's flagship ETF will demonstrate some of the points laid out in this article.

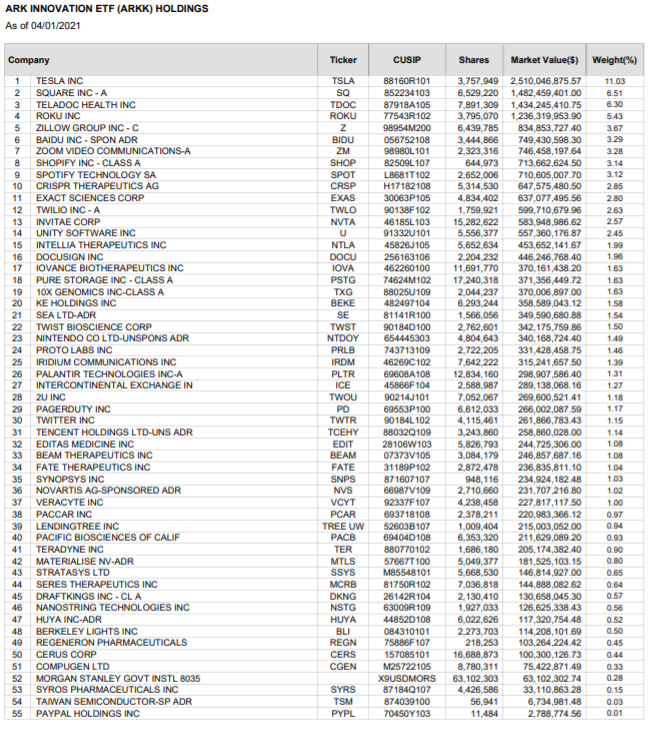

ARKK holdings

First, let's look at the holdings in Ark Innovation ETF (ARKK) and see if there is any concentration. As this is an ETF, all of this information is easily accessible and updated daily here.

AARK ETF holdings(Source: Ark Invest)

We see that as of April 1, 2021, Ark's flagship ETF had 55 holdings — far more than most individual investors would hold. We also see that its top 15 holdings make up over 55% of the total portfolio. This is pretty concentrated but if you look closer you find that its top five holdings make up nearly one-third of the portfolio!

Clearly, those top five positions are major drivers of ARKK's returns. What's more, most of their positions have a weighting of less than 1.5%. Even if one of those stocks were to double in price, its impact on the portfolio's returns would be negligible.

ARKK Backtest

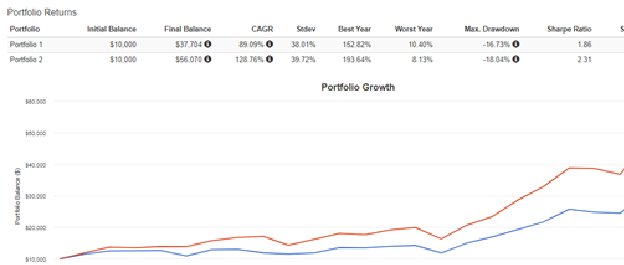

To show the power of focusing on an ETF's main holdings let's backtest ARKK's performance vs. the same percentages of ARKK's top holdings. We're going to go with the top 12 positions as that has been shown to be the sweet spot for diversification.

Comparison of returns over two years, AARK vs. its top 12 positions(Source: Portfolio Visualizer)

Note: Portfolio 1 is ARKK. Portfolio 2 is the top 12 positions in ARKK's portfolio. Also note this backtest goes back only to 2019, as its sixth-largest holding, Spotify, went public then.

As we can see, Portfolio 2, which focuses on ARKK's core positions (its high-conviction stocks), clearly outperformed ARKK. What is more impressive is that ARKK itself had a terrific bull run over the same period.

This shows the advantage available to investors willing to add a few extra steps of work in order to enjoy better returns. Better yet, an investor would have beaten Ark's fund and not paid any management fee, which for ARKK is 0.75%.

Over the long term, an investor can save plenty by not paying management fees. This strategy also helps keep their commissions low by maintaining only a core selection of stocks. Furthermore, they need only to quickly check their target ETF's holdings periodically for any changes. And with all that, they can enjoy compounding outperformance with minimal effort.

Additional strategies to consider

This article outlines an idea; where you take it is up to you. There are all sorts of tweaks and spins you can have on this simple idea to increase your returns or lower your risks.

One idea is to compare several active ETFs that interest you and have had solid performance over the last three to five years. Look at each of their holdings and try to spot any commonalities. If you see the same tickers showing up in each fund's portfolio you can guess that stock is a big part of driving the success of each of them. You could then make your own portfolio tracking only these common stocks.

Another tweak to consider is that all funds have mandates that they must abide by. For example, if they hold stock and it becomes too large a part of their portfolio due to its increase in value rapidly, they must sell shares to trim down its allocation.

Retail investors are under no such limitation. In fact, one of the keys to long-term success is to let winners run. We can let a position go for as long as it is successful. And this is a large part of long-term outperformance.

If you spot a fund trimming a core position, verify that it is simply trimming its size and isn't due to the stock's negative fundamentals. You can usually see this happen when a stock has an explosive run and after the move, the fund starts selling its shares. It's also helpful to look at the changes in that stock's weighting within the portfolio to help determine whether the fund is just trimming its weighting.

So are there free lunches on Wall Street?

To be clear this is not a guaranteed money-making strategy. If the fund underperforms, your core holdings may underperform just as badly or worse. Not paying a management fee will help mitigate that over the long term.

That is why it's important to understand why you have chosen to track the fund in the first place. And remember that a fund's performance should be measured over as long a term as possible.

This is for investors who want to be a little hands-on with their portfolio or are interested in a specific niche but know that they can't put in the hours necessary to properly build a high-quality portfolio. This isn't for those who want to do it all themselves and pick stocks independently. And this certainly isn't for those who want to passively invest.

Regardless of who you are, just going through this article should at the very least have opened your eyes to the unique advantages you have as a small retail investor over large institutional funds. And you've also seen the ways management fees and portfolio diversification affect you as an investor.

Of course, it goes without saying that I am not an investment advisor and none of this is investment advice. You should always do your own research before making any investment decisions!

This 2 minute move could knock $500/year off your car insurance in 2024

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.