An introduction to silver

Silver is known as a precious metal, along with gold, platinum, and palladium. These are called precious metals due to their scarcity. Of these four, though, silver is the most abundant.

As with gold, silver has a long history. It came into prominence when the Roman Empire began a silver-to-gold price ratio of 12:1. (When the U.S. used gold coins in the early 1900s, the ratio was a bit over 20:1.) But archeologists have found traces of silver — as well as descriptions of silver in jewelry and silverware — dating back as far as 3000 BC.

Thanks to its relative rarity and stability, people adopted silver as a means of trade. They usually priced it at a lower denomination than gold. Many regular people would not be able to afford pure gold coinage. So silver made trade easier.

Silver also has the highest electrical conduction of the elements. This makes it highly sought after for electrical wiring and related uses. However, its use is limited by its price being higher than other conductive metals, such as copper. But this characteristic will likely continue to increase demand for silver.

Discover how a simple decision today could lead to an extra $1.3 million in retirement

Learn how you can set yourself up for a more prosperous future by exploring why so many people who work with financial advisors retire with more wealth.

Discover the full story and see how you could be on the path to an extra $1.3 million in retirement.

Read MoreSilver: supply and demand

To get a clear picture of why investors should look at silver as an alternative to gold or even as a standalone investment, we first need to understand the commodity itself. As with most commodities, silver is subject to the laws of supply and demand. The price of gold on the other hand often moves due to crisis. This difference makes silver an attractive investment.

Supply

Like all metals, the principal source of silver is mining. In 2021, 822.6 million ounces were produced. Silver is one of the world's most in-demand metals and silver mining companies are popular investments. But most silver is actually mined as a by-product in the mining of other metal ores. Pure silver ore is relatively rare.

Most of the world's silver (57%) is mined in the Americas. Of note, Mexico and Peru provide about 40% of the world's production of silver. China, Russia, and Australia make up a further 22%.

Another important source of silver is recycling. Many industries that require silver, such as photography, recycle the silver used and put it back into the world's supply. However, this doesn't make it abundant. In fact, a staggering 90% of all silver ever mined has been used up. (Virtually all gold on the other hand still exists.)

This differentiates silver from gold. While silver is more abundant than gold, its supply is restricted as the metal gets used up in various industries. And as mentioned, silver is mined as a by-product of mining other metal ores.

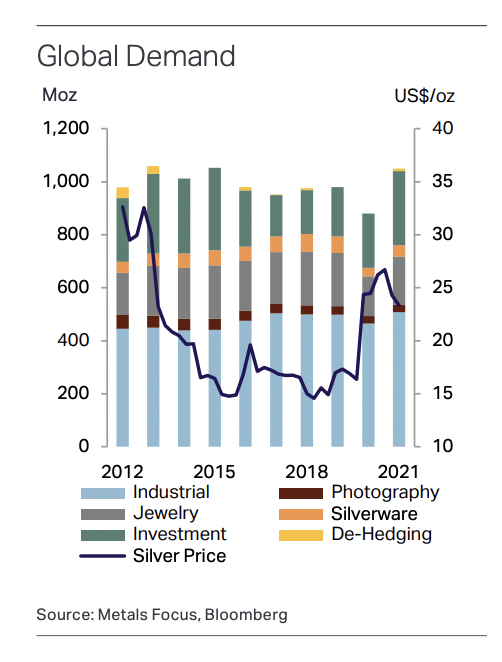

Demand

The demand side is where things really get interesting for silver. Gold for much of history has been used as a store of wealth, and that use hasn't changed much in our modern economy.

Jewelry manufacturing uses half of all gold. Investments take nearly a third. And central banks buy 15%.

Silver on the other hand has become a vital ingredient of industry.

- Electric conductivity — As mentioned, silver has the best electric conductivity of the elements. So it sees high demand in electrical wiring, circuit boards, and even nuclear reactors.

- Silver also possesses anti-microbial characteristics. This has caused a demand surge in the medical field. But this isn't new. For hundreds of years people used silver in bandages and purification tablets to stop the spread of harmful bacteria. Scientists only recently discovered why: Silver ions penetrate the bacterial cell wall and destroy the chemical bonds necessary for the bacteria's survival.

- Medical space — So silver is sure to see increased demand from the medical space. And this becomes even more certain as hospitals worldwide look for alternatives to antibiotics due to worries of new strains of antibiotic-resistant germs.

- The green space — Another interesting area that has seen increased demand for silver in recent years is the green space, specifically photovoltaic panels. In 2008, spurred on by new government subsidies, the solar industry increased its silver consumption by 155%.

- Batteries — And silver is a key component in batteries. Zinc-silver batteries have the highest efficiency in terms of energy per ounce. While the price of silver has made its use prohibitive in everyday batteries, industries that require the most efficient battery cells (such as aeronautics, space exploration and military) generate high demand for the metal.

Why investors are buying silver

Silver is increasingly becoming a key component of what has been referred to as the high-tech economy. Thanks to the demand for silver in advanced industries, silver's place in an economy will grow right along with it. Likewise, emerging markets — countries such as China that are rapidly modernizing and adopting modern technological solutions — will become larger and larger importers of the metal.

The variety of uses of silver is a key reason investors should consider it instead of gold. Gold's price on the one hand is effectively a function of economic crisis, currency debasement and jewelry manufacture. There is often not enough long-term demand for gold to absorb increases in supply. And because gold is generally recycled and rarely used up, large booms and busts occur.

Silver on the other hand has a variety of demands. This often creates a shortage in the amount of available silver. And shortages usually increase the price of the commodity. So in terms of pure supply and demand, silver paints a much brighter picture than does gold, one that investors can much more easily follow.

Diversify your portfolio by investing in art

When it comes to investing, a diversified portfolio can lead to better returns. Masterworks' art investing platform has turned a previously inaccessible asset class into an actual option for individual investors. Think of artists like Banksy, Monet or Warhol. Get priority access and skip the waitlist here.

Skip the waitlistSilver as an inflation hedge

One of the major reasons people purchase gold is as a hedge against inflation. Gold is a real asset with limited supply, in contrast to fiat currency, which can theoretically be printed infinitely. This became a point of major interest as the Federal Reserve enacted its quantitative easing (QE) policy, which escalated many fears of runaway inflation

But silver also has all of the characteristics that make gold an effective hedge against inflation. Currently inflation in the U.S. is at 8.5%, down from a high of 9.1%. This is the highest inflation has been since 1981. Reasons to consider investing in silver as an inflation hedge include:

- Silver is of course a real asset.

- And though it is more abundant than gold, its supply is still limited.

- And silver has just as rich a history as gold as a store of value.

Silver during previous gold bull markets

Of course, some investors buy gold in order to profit from a rise in the price. They don't worry much about Venezuela-level inflation or a Mad Max-style apocalypse. As with any commodity, the gold market has seen quick and spectacular rises in price. But silver has also enjoyed its own bull markets.

Now that we have made the case for why silver can be attractive, let's see how it compares to past gold bull markets.

The 1970s bull market

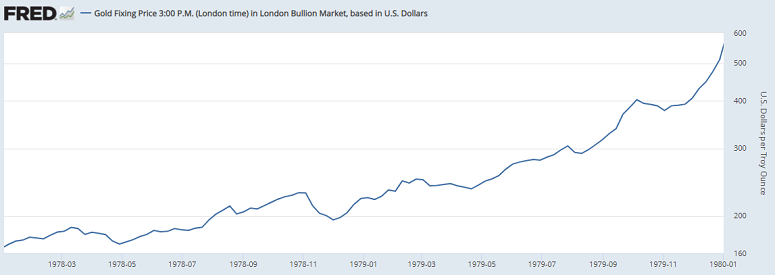

The big gold bull market everyone talks about occurred in the 1970s. The end of the gold standard coupled with double-digit inflation led to a near-mythical rise in the gold price.

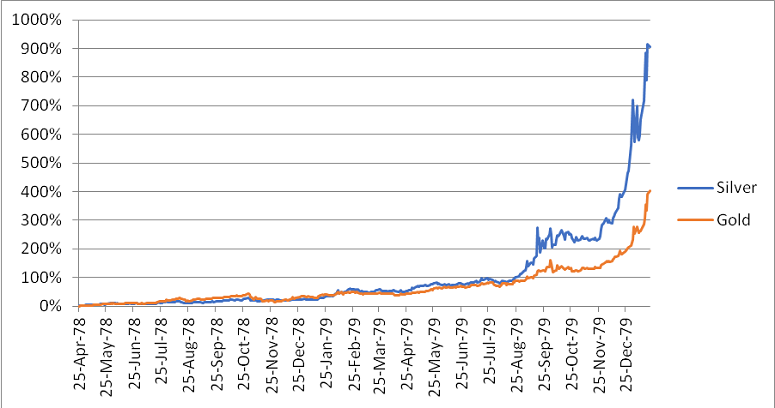

While gold rose steadily through the 1970s, in the last two years of the decade the price appeared to go parabolic as its price increased nearly six-fold. Surely nothing matched its price rise over the same period, right?

Unbelievably, over the same period of time, the price of silver managed a 10-fold gain. Despite silver's outperformance, most people remember only gold's run during this period. This could be due to people following the price of gold more than silver's price. Or maybe people focus more on the end of the US dollar being tied to the price of gold.

The 2009–2011 bull market

Some may wonder if perhaps this outperformance was a one-time event. But let's look at the most recent bull market during the late-2000s.

Silver once again outperformed gold by a significant margin during the Great Financial Crisis, with China's metal-buying spree and the EU debt crisis. Of course, past performance is no guarantee of future performance, but fundamentally this outperformance makes sense. After all, silver's price is much more sensitive to the forces of supply and demand than is gold.

As mentioned, the supply of silver can change quickly since silver continually gets used up while no new silver mines are found. And demand for silver seems to only grow as more uses are found for the precious metal.

Over the last 10 years, the silver price has been a lot more volatile than gold's on both the upside and the downside. This would explain the outperformance over the long term compared to gold but also reveals one key risk for investors: To see the long-term gains, an investor would have had to sit through multiple large losses.

The risk of investing in silver

The risk of investing in silver is the same as investing in any commodity. These assets by their nature experience continual boom-and-bust cycles. Most of the money made in commodities such as gold and silver occurs once in a generation. And many who prosper in one bull market end up giving away their gains trying to time the next move up.

Investors avoid such pitfalls by making sure their portfolio is diversified and understanding the speculative nature of owning these metals. Another way investors can avoid losses is to look at their investment in these metals as insurance for their portfolio and not as a big trade. For this, we have physical metals and once again silver offers benefits.

Physical silver vs. physical gold

We often hear that we should own physical gold as insurance against an inflation crisis or other worst-case scenario.

- The Price of gold — The big issue for most investors however is the price of gold. For example, one standard Good Delivery gold bar weighs 400 ounces and is worth $680,000 (at $1,700 per ounce). And most investors don't have that kind of cash lying around. One-ounce coins are more affordable, but at $1,700 each, this option is also unattractive to many.

- Storage — Storage also becomes a concern. It could be difficult to sleep knowing you have thousands of dollars in gold lying around the house. Professional storage is an option, but that introduces more costs to investors as well as a risk if something happens with the company holding your gold.

Silver has a major advantage, which is the same quality that made it a key piece of trade for thousands of years. It is just as trustworthy as gold for a fraction of the price. A one-ounce silver coin is worth $18. This makes it much more affordable for everyday investors.

The bottom line: what is better to invest in, gold or silver?

While gold will most likely continue to take the lion's share of press releases, silver continues to be a dependable precious metal that is far more affordable for investors. And in a bull market, it may even offer far better returns.

Today it is easier than ever for investors to get exposure to silver. You no longer have to buy physical silver but instead can buy shares in a silver exchange-traded fund (ETF) through your investment broker.

No one knows for sure if we are in another big bull market for precious metals. But if you believe we are, perhaps skip over the much-hyped gold market and consider its less famous cousin instead.

Further reading:

- How to invest in commodities

- 6 best rare earth stocks to invest in high technologies

- 7 best nickel stocks to bet on an EV-driven future

This 2 minute move could knock $500/year off your car insurance in 2024

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.