“The single biggest reason for the increase in title fraud is the internet,” says Sharma Upadhyayla, senior vice president of engineering and product strategy at Identity Guard®, an identity theft protection service.

“The internet makes it easy to gather information about properties and people, and these are the two key ingredients needed to perpetrate this crime.”

It may not be the most common of cybercrimes, but title fraud can ruin your finances all the same. Protecting yourself against it, though, is pretty easy.

What is home title fraud?

Home title fraud occurs when someone using forged identity documentation changes the deed associated with your property. If they’re successful, their name replaces yours as the owner.

Once the deed has been changed, a whole lot of ugliness can occur. Using the equity you’ve built up in your house, the thief can start applying for loans, like a home equity line of credit or even a mortgage refinance.

They get the cash, but you, without knowing it, are on the hook for the mountain of new debt they’ve created.

“Unlike credit card and bank statements, people are not in the habit of checking their deed records,” Upadhyayla says. “Homeowners are generally unaware of this activity until they start to receive foreclosure notices.”

Foreclosure, and the credit nightmare that inevitably follows, may not even be the worst possibility. Once title fraud has taken place, vacant houses — like empty investment properties or vacation homes — can even be sold without their owners’ knowledge.

More: Things not to lie about on your mortgage application

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

Officialhomeinsurance can help you do just that. Their online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesHome title fraud in the US

Home title fraud may not happen as frequently as other forms of cybercrime, like credit card fraud, but as scammers have grown more sophisticated, it’s becoming more of a threat.

“In government reporting, title fraud gets lumped in with other types of identity theft. As a result, it's difficult to pinpoint exact numbers, but we know it is on the rise from our discussions with real estate attorneys,” says Upadhyayla.

The most recent data from the FBI found almost 10,000 instances of real estate fraud in 2017. That might not seem like a lot, but the total damages — $57 million1 — should be enough to grab any homeowner’s attention.

Upadhyayla says that’s not the case.

“Despite more press on home title fraud, most Americans are still unaware of what it is and the havoc it can wreak,” he says.

Protect your identity and home

Defending yourself against title fraud requires more than just purchasing title insurance.

Depending on the kind you have, title insurance protects you or your lender against loss or damage that might result because of liens or defects in a property’s title. But it doesn’t provide ongoing protection against the relentless efforts of scammers to steal your identity and possibly your home.

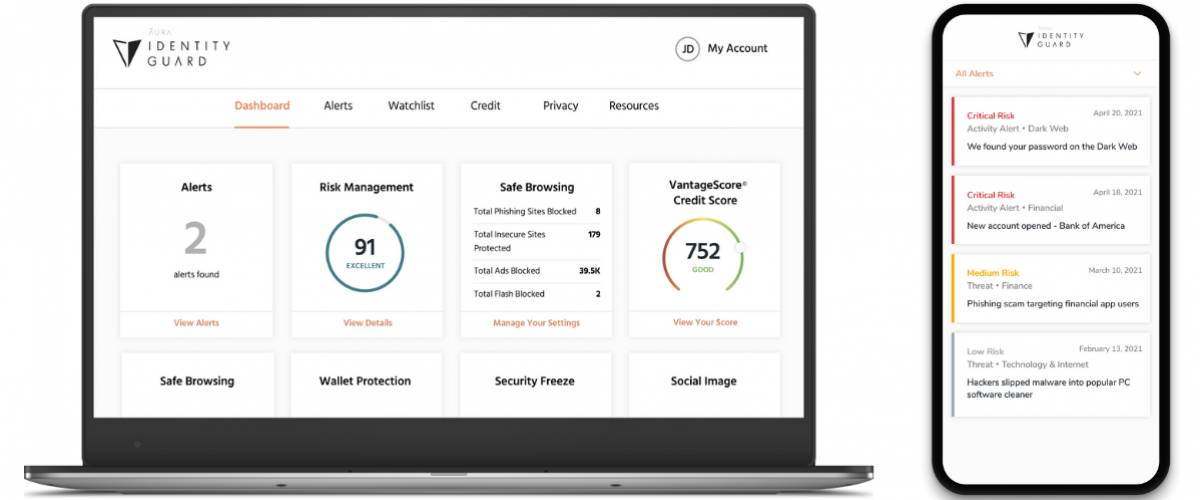

That kind of protection requires constant monitoring. If you don’t have the time or the resources required for such vigilance, don’t sweat it. Identity Guard has you covered.

Since its founding in 1996, Identity Guard has assisted more than 47 million people in securing their online presence against malicious actors, racking up thousands of stellar customer reviews on sites like TrustPilot along the way.

In addition to protecting you from title fraud, Identity Guard’s comprehensive approach to identity monitoring can also protect you from:

- Credit card theft

- Bank account theft

- Investment and 401(k) account fraud

- Phishing attacks

- Mortgage fraud

- Criminal identity theft

And getting all the protection you need is a breeze.

“A homeowner just needs to enroll in an Identity Guard plan that includes our home title monitoring feature,” Upadhyayla says.

“When they enroll, we immediately search for properties held in their name. Identity Guard then generates a report of all their properties. From that point, Identity Guard will monitor the deed records and alert you whenever a change is detected.”

Identity Guard advises all homeowners to do what they can to protect their identity, such as being careful about what information they share online, removing their personal information from data broker sites and making sure they’re not receiving bills or notices from creditors they’ve never heard of.

But even the most careful of homeowners can still have their identities snatched by tenacious scammers. Don’t let it happen to you.

This 2 minute move could knock $500/year off your car insurance in 2024

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.