1. Personality quizzes

What would the internet be without a few million mindless quizzes? A whole lot more secure, for one thing. Because the quizzes we take to pass the time don’t require much thought or attention, scammers love them as data-gathering tools.

A personality quiz might ask you for the name of your first pet, the model of your first car or where you grew up. If those questions sound familiar, it’s because the answers are commonly used for password resets and retrieval.

Once the information is fed into an unfamiliar website or posted publicly on social media, any number of accounts could be vulnerable. Soon enough the thief has enough data to reach into your savings or apply for a loan in your name.

Protect yourself:

“Thieves may not be respectable, but they can be clever,” says Sharma Upadhyayula, head of product and engineering at leading online identity monitoring firm Identity Guard®. “Telling someone your high school mascot or where your first job was could be the last detail someone needs to break into your bank account.”

Even mindless online activities require a dash of awareness. If a quiz asks you to provide personal information to participate, even if that info seems harmless, move on and pick another quiz.

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

Officialhomeinsurance can help you do just that. Their online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better rates2. A romantic heart-to-heart

Whether they take place in person or online, early dates are often extended Q&A sessions in which both participants rapturously share personal details about themselves.

If you’re an identity thief, it would be hard to think up a more ideal place to find unsuspecting people eager to expose themselves. In 2020, Americans reported losing $304 million to romance scams, an increase of 50% from the year before.1

Even if the romance is real, a data breach at a dating site could potentially expose the contents of any conversations that aren’t properly encrypted.

And since many people use the same photos or usernames on multiple sites and on social media, thieves can easily use the information they find to target other accounts that might be more vulnerable or contain more useful information.

Protect yourself:

Upadhyayula says to ensure that your antivirus software is up to date in case you click on a malicious photo or attachment sent by a scammer. If you can, make your dating profiles unique, too.

“Come up with a new username and use photos that aren’t viewable anywhere else,” Upadhyayula says. “The pics you have on popular social media sites can all show up in reverse image searches and make you, and your personal information, easier to find.”

3. Countless coronavirus scams

Thieves love a good crisis, and the COVID-19 pandemic has opened the door to a plethora of new scams. To date, Americans have reported losing more than $469 million to pandemic-related fraud.2

Here are just four ways that scam artists have taken advantage of people’s fear, confusion and financial struggles:

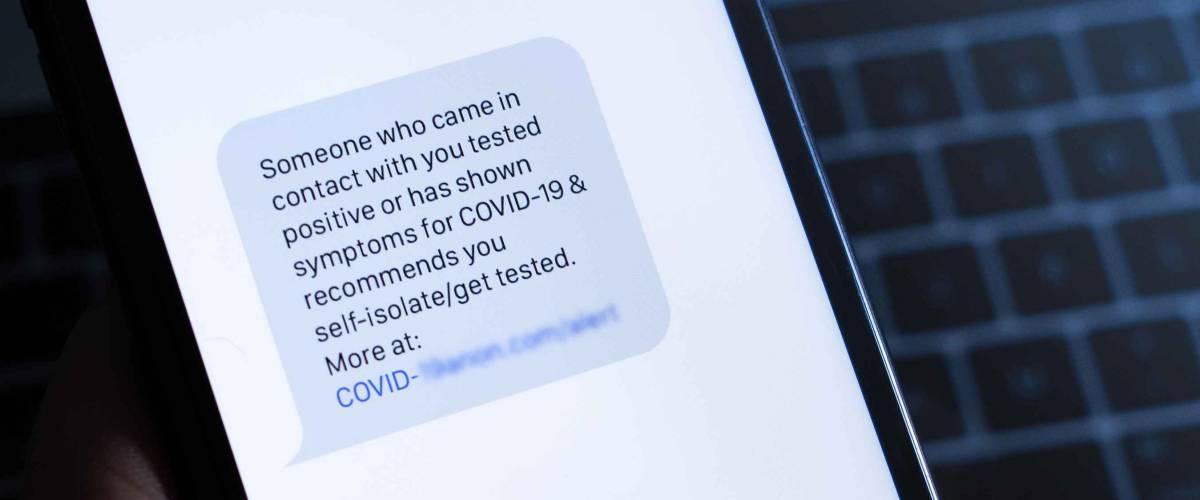

- Contact-tracing scams: Fake apps and text messages tell people they have been in direct contact with someone who has tested positive, tricking recipients into sharing their personal information to access help.

- Misinformation scams: Using an email that looks like it comes from the government or Centers for Disease Control and Prevention, crooks urge recipients to click on bogus links for essential updates, infecting their computers with malware.

- Work from home email scams: “Hey, this is John. Can you send me your phone number again? We need to talk.” Engaging with emails that look like they’re from your boss or human-resources department can put all of your personal information at risk.

- Unemployment benefits identity theft: Once they have your data, thieves use your identity to suck up your unemployment benefits — leading to a disaster the next time you need to file yourself.

It’s not easy to bounce back from these scams: Upadhyayula says that, as of April 2021, 75% of Americans hit by a pandemic-related scheme in 2020 were still fighting to resolve it.3

Protect yourself:

Upadhyayula encourages you to be wary of the tone of the emails and texts you receive.

“Don’t panic if you’re told something terrible will happen if you don’t confirm your credit card number or change a password,” he says.

He adds that any apps you use to help keep track of the pandemic should come from a trusted source, like Google Play or the Apple App Store, though scams can sometimes slip through the review process.

Kiss your credit card debt goodbye

Millions of Americans are struggling to crawl out of debt in the face of record-high interest rates. A personal loan offers lower interest rates and fixed payments, making it a smart choice to consolidate high-interest credit card debt. It helps save money, simplifies payments, and accelerates debt payoff. Credible is a free online service that shows you the best lending options to pay off your credit card debt fast — and save a ton in interest.

Explore better rates4. Bogus charities

Fake charities are always looking to prey on generous givers, but the past year and a half has been open season.

“These scams can approach you in many forms — email, phone call, social media — and are more prevalent following a natural disaster,” says Upadhyayula.

During the worst of the pandemic, when so many Americans were in dire need of help, charities were largely prevented from hosting big events or going door-to-door. So it didn’t seem that odd to see groups asking for donations on social media and via text.

Even if you’re keeping your eye out for unfamiliar names like “The Human Fund,” crooks are just as likely to steal logos from established charities to make their posts seem legitimate.

Protect yourself:

Upadhyayula says that no matter how urgent the need might seem, donors need to slow down to ensure their money is going to the right place.

“Researching a charity before you donate is always a smart first step,” he says. “And know that a legitimate charity will never ask for donations via money wire or gift card.”

5. Medical identity theft

The cost of a health care scam can really make you sick to your stomach. One study from 2015 found that 65% of victims paid an average of $13,500 to resolve the crime.3

Medical identity theft starts with someone stealing your information — maybe even a rogue employee at a health care facility — but where it goes from there depends on the scam.

A list of unpaid medical bills in your name can quickly demolish your credit score. Police could even show up at your door if the thief uses your identity to obtain a suspicious supply of painkillers.

Protect yourself:

“Keep your medical information private at all costs,” Upadhyayula says. “Never give it out over the phone unless you’re absolutely sure who you’re speaking to.”

You should also read your mail carefully to make sure you aren’t being billed for any services you haven’t received and check your credit report to ensure an unpaid medical bill hasn’t been passed on to a collections agency without you noticing.

A single solution for all identity theft worries

Keeping yourself safe from every potential online threat requires constant vigilance, and not everyone has the time or energy. Even if you do run through a won’t-be-scammed checklist every time you look at your phone or computer, some threats — like data breaches — just aren’t your fault.

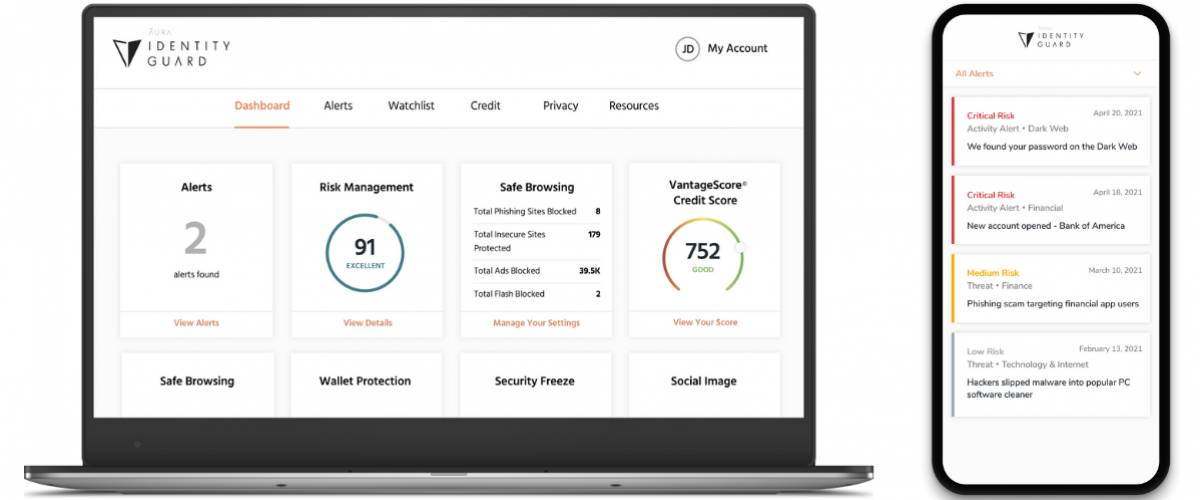

That’s why it can pay to bring in help — like the company U.S. News named America’s No. 1 identity theft protection service for 2021.

Using artificial intelligence-powered technology, Identity Guard monitors your online identity, providing protection of your registered personal information. If Identity Guard detects that your Social Security or health insurance number goes up for sale on the dark web, you’ll know.

With more advanced packages, you’ll get near real-time alerts for any strange activity or new applications to your credit file. You may even be able to act before the money starts to flow.

“With identity theft and fraud,” Upadhyayula says, “every second counts.”

In the event that a criminal breaks through your defenses, you’ll have access to $1 million in eligible losses for identity theft insurance4 and be assigned a dedicated expert who will work with you until your problem is resolved.

“Working with someone who has the history of the problem ensures that they will find the steps to move forward much faster than working with a different specialist,” Upadhyayula says. Those case managers will “be with you every step of the way to help you navigate the credit bureaus and financial institutions to resolve your incident.”

Identity Guard’s U.S.-based case managers have an average of seven years of experience and have resolved more than 150,000 identity theft and fraud cases.

Getting all of that tech and expertise on your side is surprisingly affordable. Protection starts at $7.20 per month, and even the company’s Ultra plan — which comes with three-bureau credit monitoring, home title monitoring and more — costs only $23.99 a month.

When compared to the cost of a single act of fraud, that’s a small price to pay for peace of mind.

1 What You Need To Know About Romance Scams, Federal Trade Commission

2 COVID-19 and Stimulus Reports, Federal Trade Commission

3 Fifth Annual Study on Medical Identity Theft, Ponemon Institute

4 Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group‚ Inc. The description herein is a summary and intended for informational purposes only and does not include all terms‚ conditions and exclusions of the policies described. Please refer to the actual policies for terms‚ conditions‚ and exclusions of coverage. Coverage may not be available in all jurisdictions.

This 2 minute move could knock $500/year off your car insurance in 2024

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.