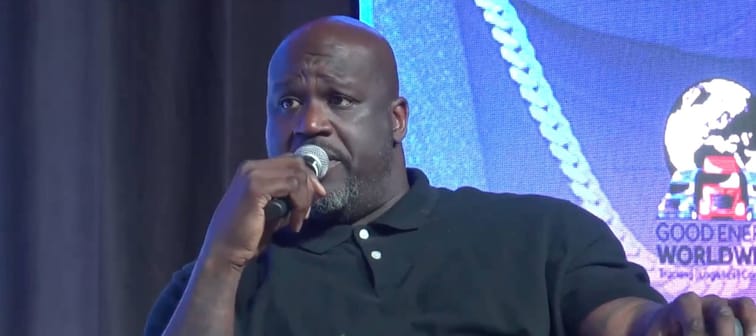

Shaq’s thrifty ride

“In college everybody had a car but me,” Shaq told podcast hosts Rashad Bilal and Troy Millings. Determined to change that, he managed to find a used Ford Bronco on the market for just $1,500.

Shaq used nearly all of the $1,800 from his Federal Pell Grant to finance the purchase, but he later discovered he hadn’t accounted for all of the costs involved.

“The guy says, ‘Hey man, before I let you drive you need insurance,’ I'm like ‘What's insurance?” he said.

After learning about auto insurance and shopping around the marketplace, Shaq was disheartened to discover that his monthly insurance rate could be as high as $300 a month. Unable to afford that on his modest budget, he tried to return the Bronco to the dealer. That’s when the dealer introduced him to The General insurance company, which agreed to give young Shaq a rate he could afford.

Shaq was so moved by this inclusive gesture he eventually signed an endorsement deal with the insurance provider.

“The reason I do commercials for The General now is, one, they took care of me when I was young, but it’s affordable insurance,” he said. “It’s really a quality insurance company just like all the other companies, but we decide we’re not overcharging people.”

However, many Americans now face a tougher environment for auto insurance than Shaq did when he was in college.

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

Officialhomeinsurance can help you do just that. Their online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesAuto insurance rates have increased in 2024

Average premiums for full coverage auto insurance (including liability, collision and comprehensive) hit $2,543 in 2024, up 26% from last year, according to a recent report by Bankrate. In some states, premiums rose even faster. New Jersey, for instance, saw a 45.69% surge in premiums over the past year. Meanwhile, in states like Florida households are spending roughly 5.69% of their income on auto insurance alone.

In this rate environment, it’s even more important to try to reduce the costs of insuring a vehicle. Bankrate’s data suggests drivers can lower their auto insurance costs by focusing on improving their driving record, boosting their credit score and choosing a low-risk, low-repair-cost vehicle model.

But shopping around for a better rate can be a more straightforward and quick way to lower insurance costs. Bundling your home and auto insurance is also worth asking your insurance provider about if you haven’t already.

A combination of some of these strategies can help drivers mitigate the impact of rising insurance costs and get a good deal for their mandatory auto coverage.

This 2 minute move could knock $500/year off your car insurance in 2024

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.